Multiple overlapping crises are threatening human rights worldwide. The Covid-19 pandemic has claimed millions of lives, caused an unprecedented loss of jobs and livelihoods, and disrupted the education of a generation of children. The Russian invasion of Ukraine exposed the frailty of global food and energy systems, contributing to an inequality and cost-of-living crisis, hunger, and the prospects of a widespread recession. Accelerating and intensifying climate shocks contribute to resource scarcity.

Decades of rising inequality has undermined the political structures and social solidarity needed to properly address these crises. Inequality has soared in the wake of deregulation and market liberalization programs pursued by many countries in recent decades. While income and wealth inequality between nations has, on average, decreased, these inequalities have become far more pronounced within nations. By 2021, just 10 percent of the world’s population captured the majority of all global income, according to the International Monetary Fund.

The United Nations estimated that more than 71 million people in low-income countries fell into poverty due to soaring food and energy prices in just the first three months of 2022. Without significant policy changes by governments and international institutions, this year’s economic situation will most likely be worse, as the International Monetary Fund recently warned.

Among other policies, such as for quality public services and financial regulation, social security and social protection provide essential tools to address and prevent these compounding crises.

Social security is a human right, dating back to the 1948 Universal Declaration, and enshrined in a range of treaties and constitutions. It is closely linked with the right to an adequate standard of living and other economic, social and cultural rights.

This question-and-answer document by Development Pathways and Human Rights Watch examines the human right to social security, and how universal social security can help protect people from economic shocks and other emerging threats, including climate-related hazards, while building just societies where all rights are realized. It also explains why policymakers should orient their policies toward establishing universal social security systems and avoid narrowly means-tested programs.

Both “social protection” and “social security” describe a range of policies and programs premised on the principle that everyone should enjoy all their economic, social and cultural rights at all stages of their lives, no matter the circumstances into which they are born or the crises or challenges they may face.

While the term “social protection” has become popular within parts of the United Nations and some international development organizations, there is no uniformly accepted definition for what it entails, and it is often poorly understood by policymakers, as reflected in the often broad and vague definitions of the term used in many governments’ national social protection strategies and policies.

The term “social security,” on the other hand, is clearly described in international human rights law as a set of individual entitlements that protect against income insecurity throughout people’s lives, including during common life events, such as old age, unemployment, sickness, or birthing and caring for dependents.

In some countries, such as the United States, “social security” has been largely conflated with a specific social insurance program that is funded by contributions from workers and employers. It is important, however, for policymakers to reclaim the term “social security” as it is understood in human rights law to describe a range of programs, whether funded from contributions or through general taxation, that are necessary for a rights-based social fabric.

Social security is a well-established human right in international law. Article 22 of the Universal Declaration of Human Rights of 1948, for example, spells out the essential elements of the right:

Everyone, as a member of society, has the right to social security and is entitled to realization, through national effort and international co-operation and in accordance with the organization and resources of each State, of the economic, social and cultural rights indispensable for his dignity and the free development of his personality.

Since then, the right to social security has been widely enshrined in countries’ national constitutions and reinforced through a range of other international conventions and frameworks. The committee charged with interpreting the International Covenant on Economic, Social and Cultural Rights (ICESCR), for example, defines this right to encompass at least nine areas of support:

States that are parties to the ICESCR assume the obligations to respect, protect, and fulfill the right to social security along each of these areas of support, including by making these programs available, accessible, acceptable, and adaptable. This also requires providing benefits, whether in cash or in kind, that are adequate in both amount and duration.

As with all other human rights, governments need also to realize the right to social security without discrimination on the grounds of gender, age, disability, race, nationality or immigration, or other status. This means that countries should be careful to ensure that the design and operation of social security systems do not directly or indirectly discriminate against anyone, such as through language or technology barriers that can cause de facto exclusion or negative treatment. As with other human rights, the right to social security should be enshrined in domestic law, and give victims of violations an effective remedy.

More recent international human rights law instruments recognize a right to social protection, in addition to and as distinct from, the right to social security. For example, a recent protocol to the African Charter on Human and Peoples’ Rights enshrines both rights separately. According to the Protocol, social security protects against income insecurity caused by events such as unemployment, sickness, or maternity. And social protection encompasses all forms of social security while also including strategies and programs that help ensure a minimum standard of livelihood, health services, and care.

In this sense, social protection corresponds to a set of policies and programs that governments need to put in place to fulfill their obligations to realize a range of economic, social and cultural rights under all circumstances, such as the rights to education, health, and an adequate standard of living, which includes the rights to food, housing, water, and sanitation, among others.

Similarly, the concept of the “social protection floor,” developed by the Committee on Economic, Social and Cultural Rights and the International Labour Organization (ILO), a United Nations agency, draws from the human right to social security, comprising at least four social security guarantees:

- access to a nationally defined set of goods and services, constituting essential health care, including maternity care, that meets the criteria of availability, accessibility, acceptability, and quality;

- basic income security for children, at least at a nationally defined minimum level, providing access to nutrition, education, care, and any other necessary goods and services;

- basic income security during people’s working life, at least at a nationally defined minimum level, for people who are unable to earn sufficient income, in particular in cases of sickness, unemployment, maternity, and disability; and

- basic income security, at least at a nationally defined minimum level, for older people.

|

Social Security and Social Protection in Select International Human Rights Law Instruments

1948 - Universal Declaration of Human Rights

1951 - Charter of the Organization of American States

1952 - ILO Convention Concerning Minimum Standards of Social Security, No. 102

1961 - European Social Charter

1976 - International Covenant on Economic, Social and Cultural Rights

1981 - Convention on the Elimination of All Forms of Discrimination against Women

1989 - Convention on the Rights of the Child

1990 - International Convention on the Protection of the Rights of All Migrant Workers and Members of Their Families

1999 - Additional Protocol to the American Convention on Human Rights in the Area of Economic, Social and Cultural Rights, “Protocol of San Salvador”

2008 - Convention on the Rights of Persons with Disabilities

2012 - ILO Social Protection Floors Recommendation, No. 202

2022 - Protocol to the African Charter on Human and Peoples’ Rights on the Rights of Citizens to Social Protection and Social Security

|

Broadly speaking, two overarching policy approaches shape the way that governments design social security systems and programs:

- Poverty-Targeted Programs, which are means-tested, and attempt to target people based on their income.

- Universal Programs, which do not limit eligibility based on peoples’ resources, but rather emphasize universal eligibility for everyone within specific groups that encompass stages of life or statuses in which people’s economic, social and cultural rights are particularly at risk (e.g., children, people with disabilities, unemployed adults, caretakers, older people, etc.).

The universal approach to social security is rooted in the notion that these protections should be provided to everyone as a right, irrespective of their income, while also recognizing that people’s economic, social, and cultural rights are most at risk during common life events. A person’s eligibility for a universal social security program is based on whether they are a member of one of these groups and not their income or wealth.

In contrast, social security programs that rely on poverty targeting prioritize means-tested programs that determine eligibility based on income or assets.

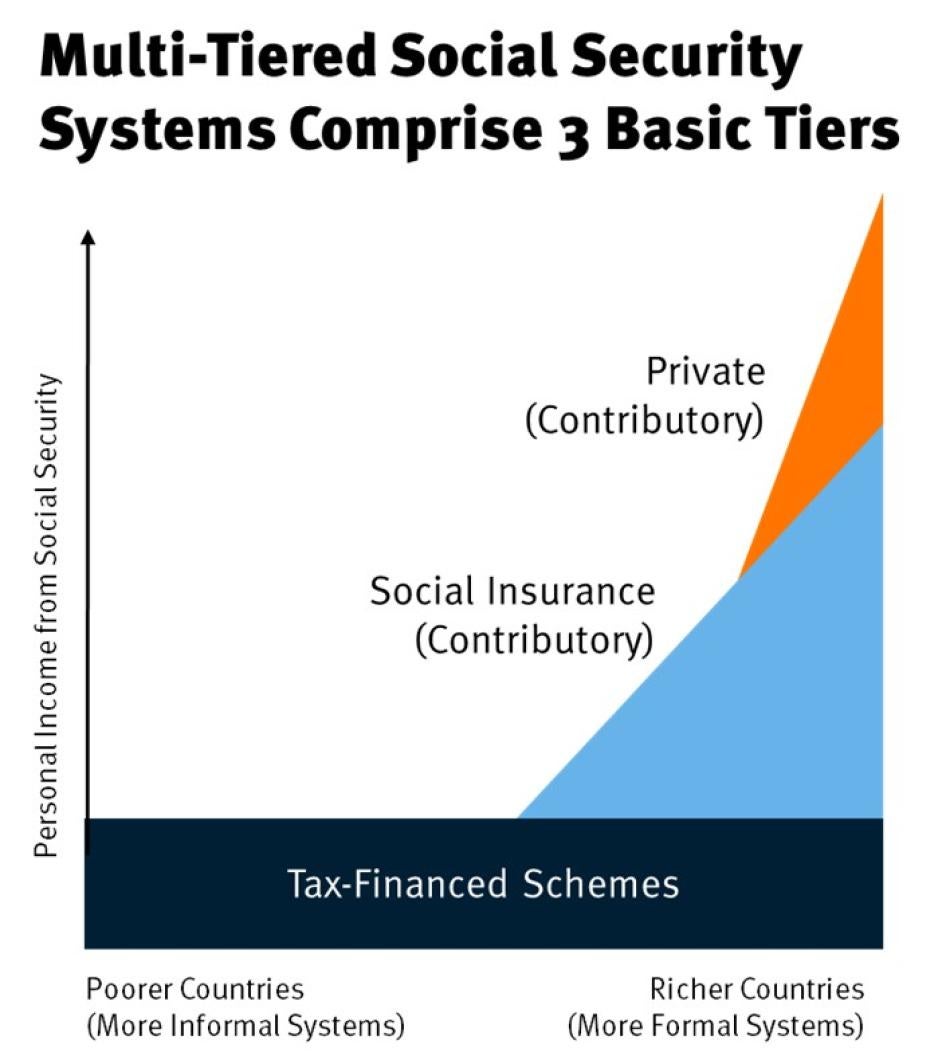

Well-designed universal social security systems combine different programs in a coherent way to create a multitiered system in which everyone has access to a set of entitlements, ensuring that they have a decent standard of living throughout their lives. This kind of multitiered system, described in the figure below, should include a tax-financed foundational tier that is offered to everyone. Countries with more resources and more formal institutions, however, should supplement this basic tier with a second tier of social security benefits for those who contribute to state-managed social insurance systems. Countries with significant resources can even have a third tier that consists of private, voluntary programs into which people can contribute to receive a higher level of benefit (e.g., 401(k) investments), which are regulated by the state.

Strengthening the tax-financed foundational tier while simultaneously encouraging the growth of social insurance programs is essential for guaranteeing the right to social security. For example, in many countries, people in formal employment who contribute into social insurance funds are then able to access income support, usually reflecting their previous earnings, when facing disability, old age, sickness, caregiving responsibilities, or unemployment. However, people who have not earned sufficient entitlements in a contributory system are still able to have secure incomes, possibly funded by progressive taxes and often on an unconditional basis, provided they fulfill eligibility criteria, such as accessing an old-age pension.

While poverty-targeted programs can play a supplementary role in social security systems, universal programs are important to ensure that everyone can enjoy their rights without being excluded on the basis of a faulty means test, bias, rigid eligibility criteria, or out-of-date information.

Poverty-targeted programs intend to target benefits to people who have already fallen into poverty. The logic behind them is seemingly straightforward: limited resources are available for social security, so their best use is to identify the populations most in need and channel resources toward them. However, data from such programs has shown that they are often exclusionary and less effective than universal systems at reaching everyone experiencing poverty or realizing everyone’s rights.

Attempting to target at-risk populations is, in practice, very difficult. Targeted programs are often designed too narrowly and exclude many people, including the poorest. This is often the case as “the poor” is not a static group, and in reality, households dynamically move between societal welfare rankings over short periods. Further, selection processes are frequently costly, inaccurate, and prone to mismanagement or corruption. Human Rights Watch research on IMF emergency loans to Kenya, Cameroon, and Nigeria, as well as Ecuador and Egypt, found major gaps in the information governments disclosed about how they had spent IMF funds, despite committing to a range of transparency measures.

Many eligible people find it hard to apply to such programs or don’t apply due to the stigma associated with poverty. In Nepal, Human Rights Watch found that many women, especially from Dalit and Muslim communities, report fearing discrimination when requesting benefits. Additionally, targeted programs have also been found to breed resentment by people who are excluded, eroding public support.

Some of the most common targeting methodologies, such as “proxy means testing,” are also often flawed. This type of test attempts to estimate the wealth of households through a complex and automated statistical approach based on analysis of household surveys to determine the main characteristics of household poverty, and then weight and rank those characteristics to determine eligibility.

But research by the International Labour Organization and Development Pathways suggests that these methods have been highly inaccurate and fall short in identifying beneficiaries, partly because the data utilized are outdated, and because of rigid or exclusionary eligibility criteria. And technology does not provide a satisfactory solution to these problems.

The eligibility criteria for means-tested programs can systematically undercount populations whose rights are at risk or not fulfilled. For example, recent Human Rights Watch research in Kazakhstan found that government officials were including extended family members’ incomes in eligibility assessments for social security programs, even when that income did not benefit the applicant, leaving many struggling households ineligible.

More fundamentally, as Development Pathways has written, by relying on a charity model that fails to build a shared sense of social solidarity or is based on everyone’s rights, poverty targeting not only undermines the utility and impact of social security programs, but it also undermines their popularity and resilience to reactionary pressures to roll back rights. From racist dog whistles around “welfare queens” in the US in the 1980s that were used to push through work requirements, to the demonization of “welfare cheats” in the UK, social security programs that are inherently framed as handouts to the poor instead of entitlements are much more at risk of being undermined.

Such targeted programs also fall short of governments’ obligations under international law. The UN Committee on Economic, Social and Cultural Rights (CESCR) has, for instance, made clear in its General Comment 19 (para. 23) that “All persons should be covered by the social security system,” which should be universal. In a 2015 statement on social protection floors, the CESCR clarified (para. 8) that this “reference to ‘all’ [in General Comment 19] encapsulates the human rights principle of universality and that every individual matters.” The CESCR also reaffirmed (para. 5) that the right to social security includes “the redistributive character of social security and its role in promoting social inclusion,” underscoring the importance of models based on a shared sense of social solidarity.

Similarly, the Protocol to the African Charter on Human and Peoples’ Rights on the Rights of Citizens to Social Protection and Social Security also demands that states parties ensure universal access to social protection (art. 24.d).

Poverty-targeted programs may still play a supplementary role in social security systems built on a foundation of universal benefits that protect all people throughout their lives, from childhood to old age. But targeted systems that exclude people without a foundation of universal protections will leave major gaps in social security that can negatively impact many peoples’ rights while failing to foster the social solidarity required for a rights-aligned society.

Social security and social safety nets have commonalities but differ in key ways. Although some safety nets may have a longer-term component, the International Labour Organization perceives safety nets as filling a transitory role, or a reactive, short-term buffer for people experiencing economically dislocating events, such as natural disasters, conflict, or economic crises. They may also reflect a different philosophy and objective, as social safety nets usually try to ensure that no one lives below the poverty line and comprise a targeted set of noncontributory transfers, but are less concerned with inequality and building social solidarity.

The World Bank generally uses the term safety nets when referring to tax-financed social assistance programs targeted at those with the lowest incomes, rather than rights-aligned social security. Social assistance defines only a subset of social protection, comprising noncontributory transfers (i.e. which are funded from general government revenue, rather than from specific contributions by individuals). In contrast, universal social security policy addresses more than just the impact of shocks and coping with their aftermath, but aims to prevent poverty, reduce economic inequality, and build social solidarity, long before crises emerge and not just in times of crisis. Safety nets play an important role in protecting people’s rights in emergency or crisis situations but should be situated in broader rights-aligned social security systems.

The rules that govern access to many forms of social security have been traditionally tailored to workers in permanent employment for a recognized employer and often funded by contributions derived from the employer/employee relationship.

Self-employed workers or those in non-standard employment relationships, such as so-called gig workers or informal workers, can find themselves without access to adequate social security coverage. For example, in the United States, most gig and informal workers are not eligible for unemployment insurance and lack access to earnings-related pensions, because these programs are contributory, with workers classified as employees paying into them.

But the focus on formal-sector workers disregards the realities of work. Globally, over 61 percent of the world’s employed population age 15 and over work informally, according to analysis published by the International Labour Organization in 2018. But the incidence of informal work is not equally distributed, with the vast majority of workers in certain regions working in informal arrangements, such as Africa (86 percent), Asia and the Pacific (68 percent), and the Arab States (69 percent). Although fewer than half of workers in the Americas and Europe and Central Asia are in informal employment, 40 percent of workers within the European Union are either informal or self-employed, another employment characteristic that can limit social security access.

The exclusion of informal workers also often has a disproportionate impact on women. Although more men labor in informal employment than women globally (63 percent to 58 percent, respectively), a much higher proportion of women labor in informal employment in low- and lower-middle income countries. In South Asia, over 80 percent of women in non-agricultural jobs are in informal employment, as are 74 and 54 percent of women in sub-Saharan Africa and Latin America and the Caribbean, respectively. Gendered norms and division in the home can often mean the burden of house-related chores and care work is placed on the women. As a result, women are often confined to working informal jobs which limits their earning capacities and access to social security.

Governments should take steps to review and reduce legal barriers to workers’ access to social security programs, regardless of whether they labor in formal, informal, or non-traditional employment. In addition to extending legal coverage, countries can provide financial incentives, simplify administrative procedures, and enhance access to services to encourage enrollment and compliance. States should also acknowledge the role of informal forms of social security, and identify ways to integrate worker-led programs.

To enable the right to social security, states should also review relevant laws and regulations outside of social security and, if necessary, modify them, particularly to clarify and adapt the scope of laws to guarantee adequate security for workers who have disguised or unclear employment relationships. Moreover, states can establish separate schemes that combine tax-financed and insurance elements for informal workers to reduce coverage gaps.

Noncitizens often face huge problems accessing social security. They may be denied or have limited access to coverage in their country of residence because of their status, nationality, or the insufficient duration of their employment or residence. At the same time, they can lose their entitlements to benefits from social security programs in their country of origin due to their absence.

As a universal right, the right to social security applies to all, regardless of citizenship or immigration status, in line with the rights to equality and nondiscrimination. Additionally, the International Convention on the Protection of the Rights of All Migrant Workers and their Families sets out the rights of migrant workers, whether documented or undocumented, to social security (art. 27) and specific public services that are often interlinked with social security coverage, including health care (art. 28) and education (art. 30).

Regional human rights systems also recognize the rights of migrants to social security and to access public services. The recent protocol to the African Charter on Human and Peoples’ Rights, for example, requires states to adopt measures to ensure that all migrants, including migrant workers, are provided with social security benefits and to ensure the portability of social security across borders, with equal treatment for people from countries of origin and countries of destination. Similarly, a 2019 resolution from the Inter-American Commission on Human Rights affirmed, as a fundamental human rights principle, the rights of every migrant to access social security on an equal basis (Principle 36), as well as health (Principle 35), education (Principle 37), and housing (Principle 38).

No, social security is a set of entitlements for everyone that is independent from the right to a living wage, which requires paying wages that ensure their ability to pay for goods and services essential to realizing human rights.

The International Covenant on Economic, Social and Cultural Rights requires states to ensure the human right to just and favorable conditions of work, which includes the right to a living wage (i.e., remuneration for all workers sufficient to ensure a decent standard of living). Policies like an adequate minimum wage are important to realizing this right by ensuring that all workers earn a specific amount from their labor, whether in the public or private sector. But even in countries with regulations requiring the payment of living wages, people may require social security in the event of unemployment or unforeseen events that prevent them from working (e.g., an illness).

Accordingly, ensuring these human rights requires more than just a living wage, but direct support from the government through social security. But without these adequate wage regulations, social security may subsidize the practices of employers who do not pay a living wage.

States should ensure both adequate social security and living wages by employers, as part of the overall system of social protection.

No. While social security programs may help ensure access to some services, such as health care or housing assistance, they are not a substitute for public services.

Social security should be part of a broader approach to policies to realize human rights. It should function alongside a robust system of quality public services that help ensure the availability of, and continuity and access to, goods and services essential to human rights, such as water, sanitation, health, education and social support, among others. There is a human right to many of the goods and services, such as water, health, and education.

Social security, in order to contribute to realizing human rights, should normally be provided to individual adults rather than households, since each individual independently holds these human rights. However, not all social security programs are designed this way, with many focusing on households instead.

Whether individuals or households are the recipients matters for the rights to equality and nondiscrimination, because resources within households are often unequally distributed and can put women, particularly older women, at a disadvantage. For example, for a program that transfers retirement money to households, as opposed to individuals, older persons may not adequately benefit. Programs directed to individuals may also reduce risks for physical or economic domestic violence against women.

Social security should thus be designed in a way that addresses power relations and unequal decision-making powers within the household, including on the basis of gender and age. However, social security targeted toward children generally goes to their primary caretakers.

Many governments are digitizing and automating core social security programs, such as cash transfers, food assistance benefits, and health insurance schemes. Some technology-assisted reforms are much-needed to ensure universal social security, such as modernizing IT infrastructure critical to the smooth delivery of benefits and services. But even necessary improvements may overlook and amplify existing social inequalities, such as the digital divide. Moving applications for social security programs exclusively online and entirely digitizing benefit payments, for example, may speed up the delivery of cash assistance during crises, but could exclude people who cannot afford mobile phones or internet access, or otherwise lack digital literacy.

Technology has also become central to how many governments now verify people’s identity, assess eligibility and benefits levels, as well as investigate, adjudicate, and impose penalties for defrauding public services.

However, Human Rights Watch has documented that such efforts may inject more complexity and arbitrariness into systems, which can prevent people from accessing benefits or legitimize social security cuts under the guise of tech-driven efficiency. Such uses of technology can profile people with low job prospects as less deserving of support and make social security recipients bear the burden of disproving digital identity verification errors. Complex and automated statistical approaches to targeting poverty may also end up excluding people in need because of unrepresentative or otherwise inaccurate data.

Yes. Whether governments can finance universal social security is essentially a question of political will and policy choices rather than resources.

Fewer than half the people on earth have access to at least one form of social security, according to International Labour Organization (ILO) analysis. But this lack of coverage is most concentrated in low- and middle-income countries, which face significant financing gaps between their current levels of funding and what is needed to support the rights to social security and an adequate standard of living.

However, a 2019 study by the ILO calculated that it would only cost an average of between 2 and 6 percent of a nation’s gross domestic product, depending on its region and country-income group, to close this financing gap and establish universal social protection floors.

The ILO has also provided helpful guidance on how low- and middle-income governments can create the fiscal space to close this financing gap by reprioritizing existing public spending, raising social security revenues through a combination of taxes and dedicated contributions, claiming aid and transfers, eliminating illicit financial flows, and managing debt, among others.

Under international human rights law, states are obliged to take steps to the maximum of their available resources to progressively realize rights, including the right to social security and other economic, social and cultural rights. The international expert committee charged with interpreting the International Covenant on Economic, Social and Cultural Rights has emphasized (para. 41) that although realizing the right to social security has “significant financial implications for States parties […] the fundamental importance of social security for human dignity and the legal recognition of this right by States parties mean that the right should be given appropriate priority in law and policy.” It further noted (para. 13):

There are options available for Governments to expand the fiscal space for social protection even in the poorest countries, for example by reallocating public expenditure with a renewed focus on social spending, increasing tax revenues, reducing debt or debt servicing, adapting the macroeconomic framework, fighting illicit financial flows and increasing social security revenues. Equally important is the evidence demonstrating that, in line with their Covenant obligations, countries cannot afford not to allocate sufficient resources to social protection given that such allocations contribute to the realization of human rights and economic and social development.

But raising additional revenue to fund social security is not a zero-sum issue. Increased funding for social security can lead to increased living standards, boosted consumption, and decreased economic inequality. With increasing global economic instability, the political will to allocate the required resources to the country’s social security sector is more critical than ever.

Creditor nations and international lenders like the World Bank and International Monetary Fund (IMF) play a significant role in funding and designing social security systems, especially in lower-income countries.

The Covid-19 pandemic led to a landmark increase in the international financing of social security. Between April 2020 and June 2022, the World Bank doubled its social security portfolio, and provided USD$30 billion in social protection financing as of September 2022. While such funding is crucial, the World Bank and the IMF have prioritized poverty-targeted approaches, which fall short in protecting human rights, rather than universal programs.

Another impediment to social security is the significant pressure that international lenders can place on debtor nations to cut public spending to fulfill public debt obligations. IMF loan programs, in particular, can impose strict limits on government spending, which often constrains governments’ investment in social security to so-called social spending floors, which the IMF sets.

A recent report by a coalition of nongovernmental organizations found that IMF-led austerity measures will affect 85 percent of the world’s population in 2023. As the IMF negotiates new lending programs with governments during this crisis period, it should avoid providing incentives for austerity harmful to human rights by ensuring that social spending floors set as conditions of lending are more than adequate to fund effective social security programs.

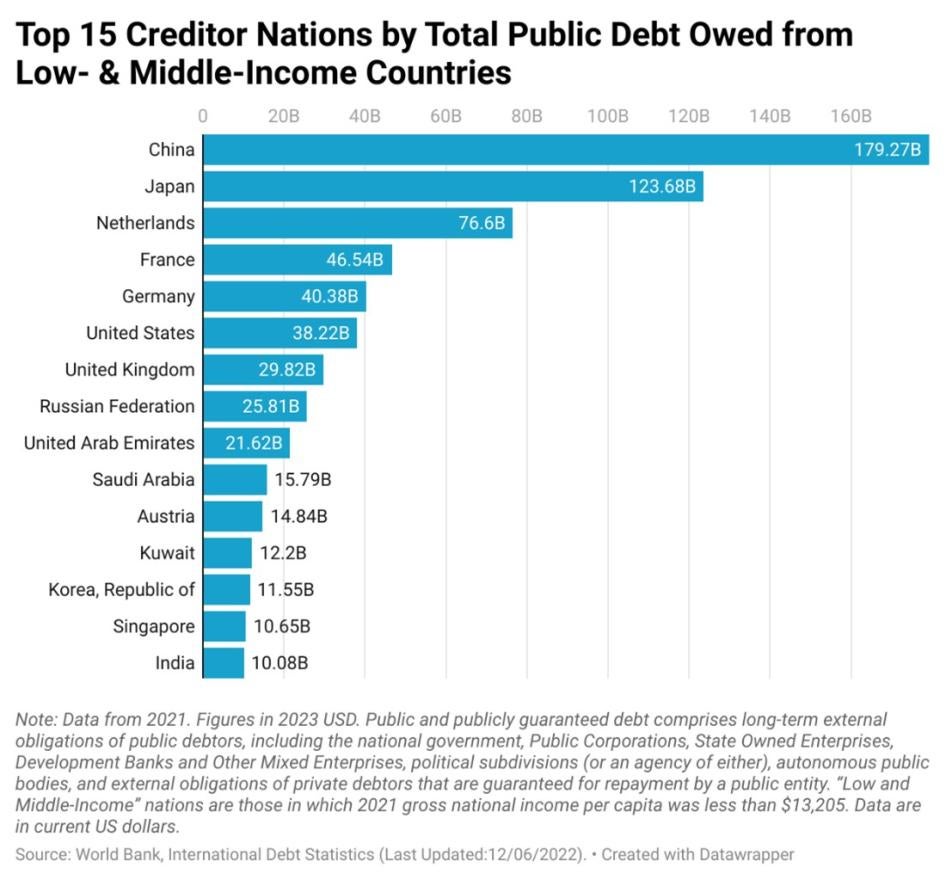

External public debt in developing economies is at record levels. Almost two-thirds of low-income countries are either in debt distress or at high risk of debt distress, a number that has doubled since 2015. In the near term, as countries such as the United States pursue monetary policies to combat domestic price inflation, increasing interest rates and borrowing costs may cause highly leveraged countries to face budget shortfalls and difficulty repaying debts.

As noted by the UN Committee on Economic, Social and Cultural Rights in a 2016 statement on public debt and austerity measures (para. 7), “The lenders also have obligations under general international law. Like any other subject of international law, international financial institutions and other international organizations are ‘bound by any obligations incumbent upon them under general rules of international law, under their constitutions or under international agreements to which they are parties.’”

It is clear that under international law, international financial institutions and bilateral lenders have an obligation to avoid causing harm by not demanding cuts or a re-design of social security programs that would undermine rights, and to provide as much resources as they can to help build universal social security systems that are rights-aligned. In addition, creditor nations and international lenders should recognize all human rights, including everyone’s right to social security.

Accordingly, the policies of wealthier nations and international institutions that own much of this public debt from low- and middle-income countries can have a significant impact on the realization of social security in other countries. In turn, they also have the opportunity to help advance equitable social security financing by prioritizing building social security systems as part of their international development assistance and also supporting a proposed Global Fund for Social Protection.

The climate crisis is a human rights crisis that affects the entire world, but its impacts are not evenly felt. About 3.5 billion people already live in contexts that are highly vulnerable to climate change, the Intergovernmental Panel on Climate Change (IPCC) recently warned. These communities are more at risk and often less prepared to adapt to the negative impacts of climate change. The IPCC says it is because of “poverty, governance challenges, limited access to public services and resources, violent conflict, and a high dependence on climate-sensitive livelihoods,” as well as “historical and ongoing patterns of inequity, such as colonialism.”

As Human Rights Watch research has shown, climate-related disasters are especially detrimental to the health and wellbeing of Indigenous peoples, pregnant people, women, and children. Expanding social security helps address this inequality with regard to climate-related hazards, increases communities’ resilience and ability to adapt, and reduces the burden on an already-overstretched international humanitarian system.

Social security is also vital for equity both within and between nations. Strong social security systems are needed to support a just transition and protect everyone’s rights in the process of decarbonization from the price effects of ending fossil fuel subsidies. Many governments have relied on fossil fuel subsidies, especially consumer subsidies, but this is an inefficient way to address energy poverty, since they are hugely expensive, disproportionately benefit wealthier households, and further the climate crisis.

However, to protect rights, it is critical to adequately invest in social security, renewables, and other measures to move toward a rights-aligned economy, since removing subsidies without doing so can disproportionately harm lower-income people by raising prices for goods and services that are essential for rights. Social security can also help secure incomes for workers and households dependent on employment in carbon-intensive industries. Despite this, only 19 percent of workers in the world are currently covered by unemployment security.

Wealthier nations that tend to be less susceptible and more resilient to climate change have disproportionately contributed to causing it. Aside from dramatically reducing carbon emissions and providing funds to mitigate the impact, these countries can help limit the human rights impact of climate change by supporting efforts by low- and middle-income countries to build robust social security systems.

Independent civil society, social movements, and labor movements are vital to ensuring that the design, implementation, and monitoring of social security programs are aligned with human rights at the local, national, and international levels. Civil society actors can contribute through their technical expertise and by providing information about the adequacy of benefit levels or barriers to access.

The ILO Recommendation concerning Social Protection Floors (no. 202) explicitly mentions the involvement of nongovernmental organizations as critical partners for the national dialogue and the monitoring process. The national dialogue can help ensure adequate social security, particularly to protect children and older people from poverty. Monitoring and benchmarking national situations against countries in similar socio-economic situations can also help create the policy space needed to advance toward universal social security.

At the international level, the Global Coalition for Social Protection Floors is an example of network-building advocating for social security. The coalition's more than 110 members conduct research and advocacy with local and national governments and international financial institutions like the World Bank and the IMF.