The organisations signed below, which jointly advocate for the right to social security, commend the Government of Mauritius for its decision to extend the universal child benefit, called the Contribution Sociale Généralisée (CSG) Child Allowance, for another year, from July 2024 to June 2025. The extension of this scheme, first introduced in 2023, highlights Mauritius’ efforts to strengthen its universal social security system.

Mauritius has long invested in universal social security. In 1958, it expanded its means-tested old age pension to a universal right for all residents over 60 years of age, and it currently spends 7.0 per cent of its GDP on the tax-financed component of universal pensions.[1] In the same year, it expanded its means-tested disability benefit to a universal programme, with current investment levels at 0.67 per cent of GDP.[2] The launch of the universal child benefit (UCB) in 2023, providing MUR2,000 (US$43) per month to all children aged 0-3 years (an investment of less than 0.15 per cent of GDP[3]), marked another significant step towards building a rights-aligned social security system.

In the 2024/2025 budget, the Government of Mauritius announced the continuation of the UCB for at least another year, still supporting the same age group of children, with an increased monthly benefit of MUR2,500 (US$52). This 25 per cent increase is an important step to fulfil children’s right to social security.

UCBs are a critical component of a rights-aligned social security system. They were first introduced in the aftermath of World War II in countries such as Ireland, the UK, Finland and Sweden - then relatively poor countries - as part of a broader commitment to protect children and invest in their economies. Today, 12 low- and middle-income countries, including the Cook Islands, Libya, Mongolia, and Montenegro, have established UCB schemes.[4] These programmes are an important investment in child well-being and development, complementing other essential public services, such as education and health care.[5] For example, in the Cook Islands, the UCB has significantly improved children’s access to education, slightly reduced poverty rates, and increased household consumption by 3.5 per cent.[6] In Nepal, the UCB has led to increased birth registration, improved access to food, and a reduced likelihood of child labour among beneficiaries and their siblings.

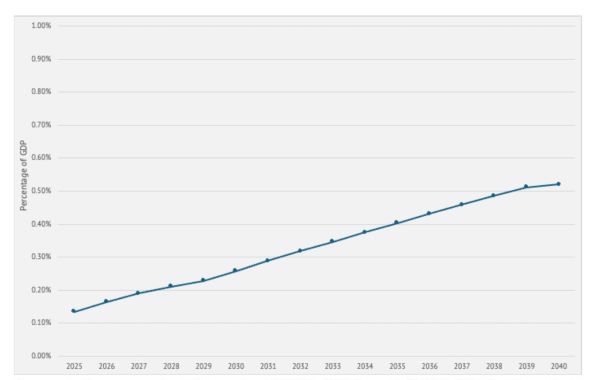

Over time, other countries that have started with a lower age of eligibility have extended the benefit to older children. The Cook Islands, for example, first introduced its UCB in 1979 for children aged 0-6 years, but today this benefit extends to all children aged 0-16.[7] If Mauritius were to follow suit and gradually extend the current CSG Child Allowance, starting from 2026, by not removing children until they reach the age of 18, it could reach all children by 2040. As shown in the graph below, the cost of implementing the UCB for children until 18 years old will cost a maximum of 0.52 per cent of GDP by 2040, when the oldest children reach 18, from 0.13 per cent in 2025. Through a phased approach, this additional contribution is manageable, including through additional government revenues from modest and sustainable economic growth.[8] It would also be a significantly lower cost than many UCBs currently implemented by other countries. We strongly encourage Mauritius to consider this projection, alongside international case studies, as evidence of the feasibility of progressively expanding the benefit to all children.

The level of investment required to build a UCB over time in Mauritius, commencing with the current CSG Child Allowance 0-3 children in 2025 with a transfer value of MUR2,500 (around US$52) per month.

Source: Authors own calculations using UNDESA (2024) and IMF WEO (2024); this excludes administrative costs.

We urge other countries to follow Mauritius’s example in expanding its universal social security system. This approach directly benefits children and families and contributes to broader societal and economic development. Mauritius demonstrates that, with proper planning and commitment, any country can, over time, build comprehensive social security systems that leave no one behind.

Signatories:

- AbibiNsroma Foundation

- Act Church of Sweden

- Action Contre les Violations des Droits des Personnes Vulnérables

- Arab NGO Network for Development (ANND)

- Asian Roundtable on Social Protection (AROSP)

- COL’OR NGO

- Development Pathways

- Free Trade Union Development Center

- Friends of the Disabled Association

- Global Coalition for Social Protection Floors (GCSPF)

- Halley Movement Coalition

- Human Rights Watch

- International Council on Social Welfare

- JusticeMakers Bangladesh in France (JMBF)

- LUTTE NATIONALE CONTRE LA PAUVRETE

- LWF Waking the Giant Africa Region Level Advocacy Platform

- Make Mothers Matter (MMM)

- MENA Fem Movement for Economic, Development, and Ecological Justice

- Monitoring Sustainability of Globalisation

- Social Policy Initiative