(伦敦)-由工会、人权和劳工权倡导团体组成的一个联盟今天发布联名报告表示,更多成衣与制鞋业者应当加入17家成衣品牌商,共同响应一项新的透明承诺。该承诺要求业者公布信息,以便倡导团体、劳工和消费者知晓其产品在何处制造。

这份40页的报告,题为《穿针引线:成衣与制鞋业供应链必须透明化》,发表于孟加拉拉纳大厦(Rana Plaza)倒塌灾难四周年前夕。该报告呼吁业者加入《成衣与制鞋业供应链透明承诺》。加入该承诺的业者同意公布其产品制造厂的信息,这为根除该产业的侵权劳动措施移除关键阻碍,并有助防范类似拉纳大厦倒塌的事故重演。

该联盟联系72家业者,要求它们加入并落实这项承诺。该报告详载各公司的回应,并依据该承诺标准对各公司供应链透明度现况做出评量。

“成衣业者的供应链透明度达到基本水平,应该成为21世纪的常态”,人权观察妇女权利部高级法律顾问阿茹娜・卡希亚普(Aruna Kashyap)说。“厂商供应链的公开透明,不仅对劳工、对人权有益,业者也可借此展现其防制供应链侵权的诚意。”

拉纳大厦倒塌案发生在2013年4月24日,造成制衣劳工死亡逾1,100人、受伤逾2,000人。此前还有两家大型工厂发生火灾──其一是巴基斯坦阿里企业(Ali Enterprises)工厂,另一件是孟加拉塔兹林成衣(Tazreen Fashions)工厂──造成350名工人死亡、多人重伤。事后,劳权团体无法确定哪些公司的产品是由上述工厂制造,必须到各该工厂去蒐寻品牌标签、访谈生还劳工,以便确认事故责任。

截至2016年底,至少29家全球成衣业者已经公布其产品制造厂的部分信息。乘著这个势头,九个劳权与人权团体和全球工会于2016年组成联盟,共同推动《透明承诺》。其目标是为该产业创造公平竞争的场域,推动该产业建立揭露供应链信息的最低限度标准。

该联盟成员包括清洁成衣运动(Clean Clothes Campaign)、人权观察、全球产业工会联合会(IndustriALL Global Union)、国际企业责任圆桌会议(International Corporate Accountability Roundtable)、国际劳工权利论坛(International Labor Rights Forum)、国际工会联合会(International Trade Union Confederation)、马奎拉团结网络(Maquila Solidarity Network)、国际工会网络(UNI Global Union)和工人权利联合会(Worker Rights Consortium)。

上述联盟成员曾致函72家公司──包括23家已经揭露供应链信息的领导品牌──要求它们加入并落实《透明承诺》标准。当时,许多成衣业者,包括某些由劳权长期不彰国家进货的,从未公布任何供应厂商的信息。

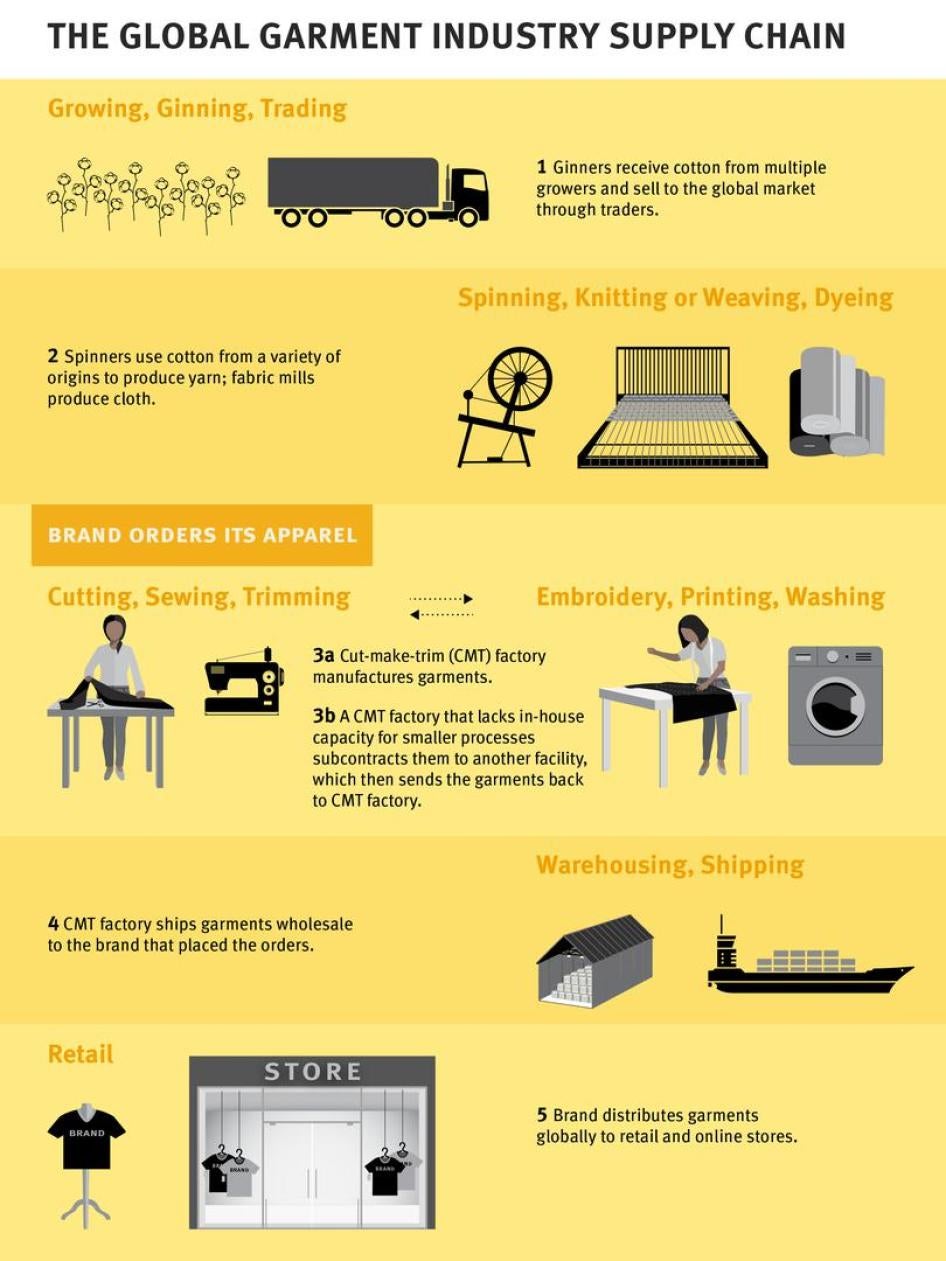

《透明承诺》内容基于许多全球成衣业者既已遵行的良好实践,为供应链透明度划出最低而非最高标准。该《承诺》要求成衣业者揭露供应厂及其合同转包商的信息。揭露供应厂信息有助伸张劳工人权,促进成衣供应链的企业伦理实践和人权尽职调查,乃至建立利益相关方之间的信任,达到《联合国商业与人权指导原则》的要求。

许多重要投资方已开始要求成衣业者公开揭露供应商信息。最近,受到代表5.3万亿美元资产的85个投资方支持的《企业人权基准》对成衣业者的供应链透明度做了评分,要求业者至少应公布其上游生产工厂的名册。

“拉纳大厦和其他灾难已让人权组织、工会和部分企业与投资方看到,透明度对于防范侵权和履行企业责任有多么重要”,清洁成衣运动国际办公室游说与倡导协调员班・凡比柏斯垂特(Ben Vanpeperstraete)说。“企业必须将透明原则付诸实践,才能展现其对人权与体面劳动条件的尊重。”

该联盟表示,透明是促进企业责任、保护全球供应链成衣劳工权利的有力工具。它让工人和劳权及人权倡导团体有能力向业者发出警告,注意其供应厂商的侵权情况。品牌供应厂商的信息有助于及时启动人权侵犯的申诉和救济机制。

在该联盟联系的72家公司之中,有17家公司将在2017年12月前完全达到《承诺》标准。

另有多家公司未充分达到《承诺》标准:5家已接近《承诺》标准;18家已朝正确方向迈进,至少公布加工厂的名称和地址;还有7家正准备小范围揭露供应厂信息──例如在2017年12月前公布部分供应厂,或至少公布供应厂名称和生产国。

另外25家成衣业者则完全不公布商品生产厂商的信息。这些公司或者不予回覆,或者不同意公布联盟索要的各项信息。

该联盟要求尚未达到《承诺》标准的业者在今年12月之前改善,以便协助提升成衣业趋近供应链透明的最起码水平。

“遵守《承诺》要求的供应链透明最低水平,对履行企业责任至关重要”,国际劳工权利论坛执行董事茱蒂・吉尔哈特(Judy Gearhart)说。“业者可以做得更好,但至少应从此一基本措施起步。”

有些公司声称揭露信息将削弱其商业优势。但该联盟指出,对照其他已经公布相关信息的业者,这种说词显然站不住脚。正如Esprit ──已同意加入《承诺》的一家业者──表示,“揭露这些信息对许多公司来说并不好受,但它已是时代的要求。”

充分符合或接近充分符合《承诺》标准的成衣业者

先前已公布供应链信息,和同意在2017年12月前进一步公布供应厂信息,充分符合《承诺》标准的成衣业者包括:adidas(阿迪达斯)、C&A(西雅衣家)、Cotton On集团、Esprit、G-Star RAW、H&M集团、Hanesbrands、Levis(李维斯)、Lindex、Nike(耐克)和Patagonia。

先前尚未公布任何供应厂信息,但同意将公布信息以充分符合《承诺》标准的成衣业者包括:ASICS(亚瑟士)、ASOS、Clarks(其乐)、New Look、Next和Pentland Brands。这些全球成衣业者将有助开拓新境,推动建立供应链透明的产业最低标准。

John Lewis、Marks and Spencer、Tesco(特易购)、Gap和Mountain Equipment Co-op等业者则坚持略低于《承诺》标准的透明实践。

走在正确方向

Coles、Columbia Sportswear(哥伦比亚)、Disney(迪士尼)、Hudson’s Bay Company、Kmart(凯玛特)与Target Australia(塔吉特澳大利亚)和Woolworths Australia等业者均已公布供应厂名称及地址,但尚未同意进一步达到《承诺》标准。Puma和New Balance已经公布部分供应厂名称及地址,并已同意提供更多详细资料以向《承诺》标准靠近。

ALDI North和ALDI South(奥乐齐)、Arcadia集团、Benetton(贝纳通)、Debenhams、LIDL、Tchibo、Under Armour和VF Corporation(威富公司)等业者正在朝向正确方向努力,并已开始或即将于2017年开始,至少公布所有加工厂的名称与地址。日本迅销公司(Fast Retailing)已于2017年公布旗下品牌UNIQLO(优衣库)“核心代工厂名录”,包括工厂的名称和地址。

小范围揭露供应厂信息

Target USA(塔吉特美国)先前已公布供应厂名称与生产国,但未同意更多透明措施。2017年, Mizuno(美津浓)、 Abercrombie & Fitch(阿贝克隆比&费奇)、Loblaw和PVH Corporation等业者已采取措施公布供应商名称,但仅附带说明生产国。

BESTSELLER和Decathlon(迪卡侬)已同意将于2017年公布供应厂信息,但未说明将公布哪些具体内容。

未同意公布供应厂信息

American Eagle Outfitters(美鹰傲飞)、Canadian Tire、Carrefour(家乐福)、Desigual、DICK’S Sporting Goods、Foot Locker、Hugo Boss、KiK、MANGO、Morrison’s、Primark、Sainsbury’s、The Children’s Place和Walmart(沃尔玛)等业者未同意公布供应厂信息。Inditex拒绝公布供应厂信息,但愿将相关资料提供全球产业工会联合会(IndustriALL)及其成员组织,纳入该公司《全球框架协议》报告。

Armani、Carter’s、Forever 21、Matalan、Ralph Lauren Corporation、Rip Curl、River Island、Shop Direct、Sports Direct和Urban Outfitters等业者未予联盟答覆,也没有公布任何供应链信息。

已加入全球产业工会联合会全球框架协议并公布部分供应厂信息的品牌商:

H&M集团和Mizuno;Tchibo将从2017年起公布。

已加入《孟加拉消防及建筑物安全协定》并公布供应厂信息的品牌商:

已公布供应厂信息的协定成员包括:adidas、C&A、Cotton On集团、Esprit、G-Star RAW、H&M集团、Kmart Australia、Lindex、Marks and Spencer、Puma、Target Australia和Woolworths。

已开始或将自2017年开始公布部分供应厂信息的协定成员包括:

Abercrombie & Fitch、ALDI North和ALDI South、BESTSELLER、Debenhams、Fast Retailing、John Lewis、New Look、Next、LIDL、Loblaw、PVH Corporation、Tchibo和Tesco。

已加入《德国可持续纺织业伙伴关系》(Textil Bündnis)并公布供应厂信息的品牌商:

Adidas、C&A、Esprit、H&M和Puma;此外,ALDI North和ALDI South、LIDL和Tchibo等业者已开始或将自2017年开始公布供应厂信息。

| Current/Anticipated Disclosure by December 31, 2017 vs. Pledge Standards | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Company | Headquarters | Published supplier factory--cut-make-trim (CMT) and subcontractor-- information prior to Pledge Letter? | Supplier factory information published meets or will meet Full Pledge by December 2017? | Names and street addresses of CMT factories and their subcontractors | Worker numbers | Product types | Parent company information | Frequency of disclosures | Time Frame to Implement Pledge |

| Abercrombie & Fitch | US | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names of tier-1 factories (CMT for woven, denim, knit, sweater, intimates,and accessoroies) with country of manufacture, but without street address. | No | No | No | 2 times per year | 2017 |

| Adidas | Germany | Names of all tier-1 factories, including those used by licensees as well as authorized subcontractors, by country and city. Names of all tier-2 wet process suppliers, by country and city. Separate lists of supplier factories used for the Olympic Games. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 2 times per year | 2017 |

| ALDI North and ALDI South | Germany | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names and addresses of tier-1 (CMT) factories but not their subcontractors. | No | No | No | 1+ times per year | 2017 |

| American Eagle Outfitters | US | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Arcadia Group | UK | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names and addresses of tier-1 (CMT) factories but disclosure of authorized subcontractors will need more time. | No | No | No | 1+ times per year | NA |

| Armani | Italy | None | No response to coalition letter. | No | No | No | No | NA | NA |

| ASICS | Japan | None | Full Pledge alignment. | Yes | Yes | Yes | Yes | 1 time per year | 2017 |

| ASOS | UK | None | Full Pledge alignment. | Yes | Yes | Yes | Yes | 6 times per year | 2017 |

| Benetton | Italy | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names and addresses of tier-1 (CMT) factories but not their subcontractors. | No | Yes | No | 1 time per year | NA |

| BESTSELLER | Denmark | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Company stated that tier-1 (CMT) factories will be published but did not provide more information about what precisely will be disclosed for each factory. | No information | No information | No information | No information | 2017 |

| C&A | Netherlands | Names and addresses of all CMT factories. Excluded: Brazil, Mexico, and processing factories. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 2 times per year | 2017 |

| Canadian Tire | Canada | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Carrefour | France | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Carter's | US | None | No response to coalition letter. | No | No | No | No | NA | NA |

| Clarks | UK | None | Full Pledge alignment. | Yes | Yes | Yes | Yes | 2 times per year | A vast majoirity of the supplier factory information will be published in 2017. Five percent of non-footwear accessories to be published in 2018. |

| Coles | Australia | Names and addresses of CMT factories, but not subcontractors. Company states that its supplier factories use minimal subcontracting. | No additional commitments to meet Pledge standards; maintaining status quo. | Names and addresses of CMT factories, but not subcontractors. Company states that its supplier factories use minimal subcontracting. | No | No | No | 1 time per year | NA |

| Columbia Sportswear | US | Names and addresses of factories from which they directly source and any external subcontractors engaged to perform finishing processes (mostly limited to collegiate suppliers since the others have in-house capacity). | No additional commitments to meet Pledge standards; maintaining status quo. | Yes | No | No | No | 1 time per year | NA |

| Cotton On Group | Australia | Names and addresses of CMT factories used by top 20 suppliers. | Full Pledge alignment. | Yes | Yes | Yes | Yes | Multiple | 2017 |

| Debenhams | UK | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names and addresses of tier-1 factories which includes all CMT factories; some external processing such as embroidering and washing may not be included. | Yes | No | No | No information | 2017 |

| Decathlon | France | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Company did not provide more information about what precisely will be disclosed for each factory. | No information | No information | No information | No information | 2017 |

| Desigual | Spain | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| DICK'S Sporting Goods | US | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Disney | US | Names and addresses of all facilities part of Disney's vertical supply chain and any facility in its vertical supply chains where Disney intellectual property is located, which includes any laundry, printing, embroidery facility if Disney intellectual property is incorporated into that finished product or component. | No additional commitments to meet Pledge standards; maintaining status quo. | Names and addresses of all facilities in its vertical supply chain, including subcontractors, where Disney intellectual property is located. | No | No | No | 1 time per year | NA |

| Esprit | Germany | Names and addresses of CMT factoriesand their authorized subcontractors. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 2 times per year | 2017 |

| Fast Retailing | Japan | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Published name and addresses of "Core Factories"producing for UNIQLO brand, representing 80 percent of the total volume of orders for UNIQLO brand. Plans to publish a list of GU's "major partner factories" in 2017. No clear commitment to publish subcontractors in 2017. | No | No | No | 1 time per year | 2017 |

| Foot Locker | US | Previously disclosed names and addresses for suppliers of collegiate apparel line that is currently inactive. | No commitment to publish current own-brand supplier factory information. | No | No | No | No | NA | NA |

| Forever 21 | US | None | No response to coalition letter. | No | No | No | No | NA | NA |

| G-Star RAW | Netherlands | Names, addresses, product types, parent company, and worker numbers for CMT factories. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 2 times per year | 2017 |

| Gap | US | Names and addresses of CMT factories and their authorized subcontractors. | Almost full Pledge alignment. | Yes | Yes | Yes | No | 2 times per year | Gap did not make any new commitments to align with the Pledge by December 2017. The company updated its supplier factory information to be more closely aligned with the Pledge. |

| H&M Group | Sweden | Names and addresses of supplier factories and vendors (suppliers), processing factories, and some fabric suppliers. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 4 times per year | 2017 |

| Hanesbrands | US | Names and addresses of collegiate suppliers and owned factories. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 4 times per year | 2017 |

| Hudson's Bay Company | Canada | Names and addresses of some, but not all, supplier factories. | No additional commitments to meet Pledge standards; maintaining status quo. | Names and addresses of some, but not all, CMT factories. | No | No | No | 1 time per year | NA |

| Hugo Boss | Germany | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Inditex | Spain | CMT factories not published. Names and addresses of direct and indirect wet processing factories published. | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| John Lewis | UK | None | Almost full Pledge alignment. | Yes | Yes | Yes | No | 2 times per year | 2017 |

| KiK | Germany | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Kmart Australia | Australia | Names and addresses of factories in "high risk" countries. | No response to coalition letter. | Names and addresses of factories in "high risk" countries. | No | No | No | No information | NA |

| Levi Strauss | US | Names and addresses of CMT factories and authorized subcontractors. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 2 times per year | 2017 |

| LIDL | Germany | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names and addresses of tier-1 factories which includes all CMT, but does not include all processing facilities. | No | No | No | 2 times per year | 2017 |

| Lindex | Sweden | Names and addresses of CMT factories. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 1 time per year | 2017 |

| Loblaw | Canada | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names of all factories where they Òsource apparel and footwear directlyÓ with country of manufacture but not street address. | No | No | No | 2 times per year | 2017 |

| MANGO | Spain | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Marks and Spencer (M&S) | UK | Names and street addresses, worker numbers, gender breakdown, and product types. | Almost full Pledge alignment. M&S will continue with its Plan A disclosure commitments and add processing factories and also make its existing disclosure available in a searchable format. | Yes | Yes | Yes | No | 2 times per year | 2017 |

| Matalan | UK | None | No response to coalition letter. | No | No | No | No | NA | NA |

| Mizuno | Japan | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names along with country of manufacture of "Core Suppliers," that is, 125 factories disclosed of 464 tier-1 suppliers as reported on Mizuno website. | No | Yes | No | No information | Began disclosure in 2017. |

| Morrison's | UK | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Mountain Equipment Co-op (MEC) | Canada | Names and addresses of all CMT factories and some processing facilities. | Almost full Pledge alignment. | Names and addresses of all CMT factories and some processing facilities. | Yes | Yes | Yes | 2 times per year | Additional details for CMT factories to meet Pledge standards will be published in 2017. Names and other details of authorized printers will be added subsequently. |

| New Balance | US | Names and addresses of direct supplier factories, excluding US wholly-owned facilities. | Not full Pledge, but will add product type, and update annually in searchable format. | Names and addresses of direct supplier factories, excluding US wholly-owned facilities. | No | Yes | No | 1 time per year | 2017 |

| New Look | UK | None | Full Pledge alignment. | Yes | Yes | Yes | Yes | At least annual | 2017 |

| Next | UK | None | Full Pledge alignment. | Yes | Yes | Yes | Yes | 2 times per year | 2017 |

| Nike | US | Names, addresses, product category, worker numbers, gender and migrant worker breakdown, and authorized subcontractor. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 4 times per year | 2017 |

| Patagonia | US | Names, addresses, product category, worker numbers, gender breakdown, and parent companies of CMT and authorized subcontractors. Some fabric suppliers indicated. One cotton farm also disclosed. | Full Pledge alignment. | Yes | Yes | Yes | Yes | 1 time per year | 2017 |

| Pentland Brands | UK | None | Full Pledge alignment. | Yes | Yes | Yes | Yes | 2 times per year | 2017 |

| Primark | UK | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Puma | Germany | Name of factory by country, city for tier-1 "core suppliers" and tier-2 material and component suppliers. | Almost full Pledge alignment for tier-1 "core suppliers" factories. | Names and addresses of tier-1 "core suppliers" amounting to 80 percent of their total business volume. But authorized subcontractors (if any) are not included in the definition of "core suppliers." | Yes | Yes | No | 1 time per year | 2017 |

| PVH Corporation | US | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names of CMT factories along with country of manufacture but without street address. | No | No | No | 2 times per year | 2017 |

| Ralph Lauren Corporation | US | None | No response to coalition letter. | No | No | No | No | NA | NA |

| Rip Curl | Australia | None | No response to coalition letter. | No | No | No | No | NA | NA |

| River Island | UK | None | No response to coalition letter. | No | No | No | No | NA | NA |

| Sainsbury's | UK | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Shop Direct | UK | None | No response to coalition letter. | No | No | No | No | NA | NA |

| Sports Direct | UK | None | No response to coalition letter. | No | No | No | No | NA | NA |

| Target Australia | Australia | Based on information on its website, Target Australia appears to disclose the names and addresses of CMT factories. | No response to coalition letter. | Names and addresses of CMT factories appear to be disclosed. The coalition has no information about percentage of supplier factories disclosed or other exclusions, if any. | No | No | No | Company website says "regular basis." | NA |

| Target USA | US | Names and countries of CMT suppliers, textile and wet processing factories. | No additional commitments to meet Pledge standards; maintaining status quo. | Names of CMT factories along with country of manufacture but without street address. | No | No | No | 4 times per year | NA |

| Tchibo | Germany | None | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names and addresses for CMT factories. | Yes | Yes | No | No information | NA |

| Tesco | UK | Names and addresses of Bangladesh supplier factories only. | Almost full Pledge alignment. | Yes | Yes | Yes | No | 2 times per year | 2017 |

| The Children's Place | US | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Under Armour | US | Only suppliers factories for collegiate apparel. | Not full Pledge, but will begin publishing supplier factory information in 2017. | Names and addresses for all CMT factories (but not embellishers or subcontractors). | Yes | Yes | Yes | No information | Pledge details for CMT factories will be published in 2017. |

| Urban Outfitters | US | None | No response to coalition letter. | No | No | No | No | NA | NA |

| VF Corporation | US | Names of factories by country for all VF brands of all VF-owned and operated, and direct sourced, tier-1 supplier factories. | Not full Pledge, but will include street addresses to align more with the Pledge. | Names and addresses of all CMT factories but not those used by licensees and subcontractors. | No | No | No | Regular | 2017 |

| Walmart | US | None | No commitment to publish supplier factory information. | No | No | No | No | NA | NA |

| Woolworths | Australia | Names and addresses of all sites in Bangladesh are disclosed, and overall more than 40 percent of the supply chain (for apparel and footwear) is published. | No additional commitments to meet Pledge standards; maintaining status quo. | Names and addresses of all sites in Bangladesh are disclosed, and overall more than 40 percent of the supply chain (for apparel and footwear) is published. | No | No | No | 4 times per year | NA |