(Washington, DC) – The United States government has made little progress in stemming the rise in poverty and inequality during the Covid-19 pandemic, Human Rights Watch said today. The government should take urgent action to address the rights of millions of people suffering the compounded economic and social impacts of the pandemic.

A Human Rights Watch analysis of public-use microdata from the Census Bureau Household Pulse Survey shows that the pandemic’s economic fallout has had a devastating and disproportionate impact on the rights of low-income people who were already struggling. President Joe Biden’s American Rescue Plan, a $1.9 trillion coronavirus relief bill passed by the US House of Representatives on February 27, 2021, provides key investments to mitigate the growing economic hardship affecting these parts of the population. The legislation is now with the Senate, where it may be amended before it is sent back to the House for a final vote.

“Millions of people in the US are falling into preventable poverty and hunger,” said Lena Simet, senior poverty and inequality researcher at Human Rights Watch. “The measures put forth in President Biden's relief proposal are urgently needed and the government shouldn’t cut corners when so many lives and livelihoods are at risk.”

Federal policymakers should ensure that relief not only reaches everyone in need, but also provides sufficient levels of support. It should also lay the foundation for a human rights-based economic recovery that ensures an adequate standard of living to everyone in the United States and addresses racial, gender, and other disparities, Human Rights Watch said.

Since the start of the pandemic, 74.7 million people have lost work, with the majority of jobs lost in industries that pay below average wages. Many of those who lost work and income are running out of money and savings. In January, some 24 million adults reported experiencing hunger and more than six million said they fear being evicted or foreclosed on in the next two months due to their inability to make housing payments. By contrast, higher-income people have been relatively unscathed economically. Despite the worst economic contraction since the Great Depression, the collective wealth of the US’ 651 billionaires has jumped by over $1 trillion since the beginning of the pandemic, a 36 percent leap.

Recent Census Bureau data show how households with different incomes are coping with the pandemic and that low-income households are disproportionally struggling for their social and economic rights to be met. Among households with incomes below $35,000, 47 percent of adults report being behind on housing payments, and 25 percent say they struggle to put food on the table. Thirty-two percent of low-income adults said they had felt depressed in the previous seven days. These low-income households urgently need a comprehensive rescue plan.

One-third of adults reported using past stimulus payments and enhanced unemployment benefits to cover normal household expenses in the previous seven days; with 37 percent of them also going into debt by using credit cards and loans for routine expenses.

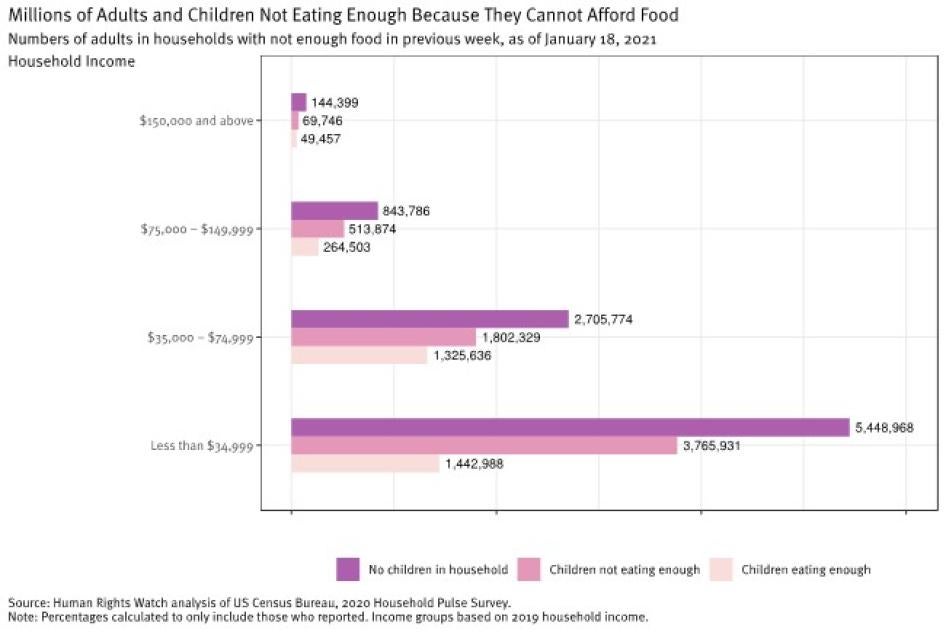

At the end of January, the data indicated, more than 24 million adults had not had enough to eat sometimes or often in the previous seven days. That is five million more than in August 2020, when food hardship was already higher than before the pandemic. Human Rights Watch found that more than half of food-insecure households include children, raising serious concerns about the long-term consequences on children’s health and their academic outcomes. More than 45 percent of food-insecure households are in the lowest income quartile, making less than $35,000 a year. Racial disparities are high, with Black and Latinx adults living in food-insufficient households at more than twice the rate of white adults.

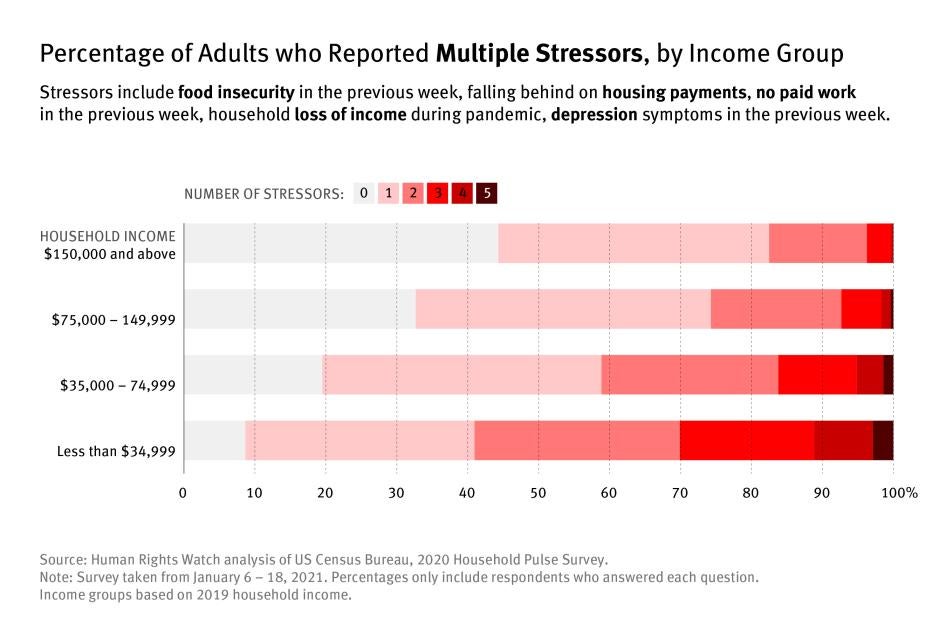

Human Rights Watch found that low-income households are at a particular disadvantage in recovery, because many experience multiple stress factors (“stressors”), such as housing insecurity. Sixty percent of households making less than $35,000 a year face at least two stressors simultaneously, compared to less than 20 percent of households making more than $150,000. These compounding stressors can push families and individuals deeper into poverty and represent a risk to people’s rights.

“Government programs and past stimulus bills have provided crucial relief, but it was temporary,” Simet said. “Food and housing insecurity is rising and millions of people are going hungry or are on the brink of losing their home or seeing their utilities shut off in one of the world’s wealthiest countries. It’s a clear indictment of a failed safety net and the urgent need to address people’s rights to food and housing.”

The disproportionate impact of the pandemic on low-income people underscores the urgency of addressing the precarious financial situation that low-wage workers faced even before the pandemic, Human Rights Watch said. Raising the minimum wage to a living wage is one effective mechanism. It is also effective for combatting poverty and addressing wage inequality. Some legislators’ opposition to Biden’s proposal to raise the federal minimum wage to $15 an hour as part of the rescue plan undermines an equitable recovery and puts low-wage earners further at risk, particularly women and workers of color, who continue to be shunted into the lowest-paid jobs.

A safety net will need to protect those who need it. Presently, the US’ largest economic and health support systems are geared largely toward supporting children and their parents, people with disabilities, and older people. These programs are often insufficient to ensure the right to an adequate standard of living for these groups.

But they also fail to respond to the needs of low-income people outside of these categories, who have fewer options for government support, and often fall through the cracks. In 2020, more than one in eight adults under the age of 65, without children and who do not have a disability, were living in poverty, according to the Center on Budget and Policy Priorities.

“If the US government wants to address the economic insecurity and inequality that the pandemic has exposed and exacerbated, it needs to make ensuring economic and social rights for all a priority,” Simet said. “This means building a universal and strong social protection system and investing in public services, notably education, health care, housing, and an adequate standard of living.”

For additional details about the situation in the United States and the need for stimulus relief, please see below.

Evidence of Economic Hardship in the US and Necessary Support

These findings are based on a Human Rights Watch analysis of public-use microdata from the Census Bureau Household Pulse Survey. For a detailed description of the data, see here.

Job and Income Losses Disproportionately Affect the Most Vulnerable

As of January 2021, about one year into the pandemic, the US economy remained weak, the jobs recovery had lost momentum, and there were 9.9 million fewer jobs than in February 2020, when the pandemic began. In the Pulse survey analyzed by Human Rights Watch, nearly half of adults who responded – 48 percent – said that someone in their household had experienced a job or income loss at some point since March 13, 2020. Latinx and Black adults were 1.4 times more likely to have answered “Yes” than white adults.

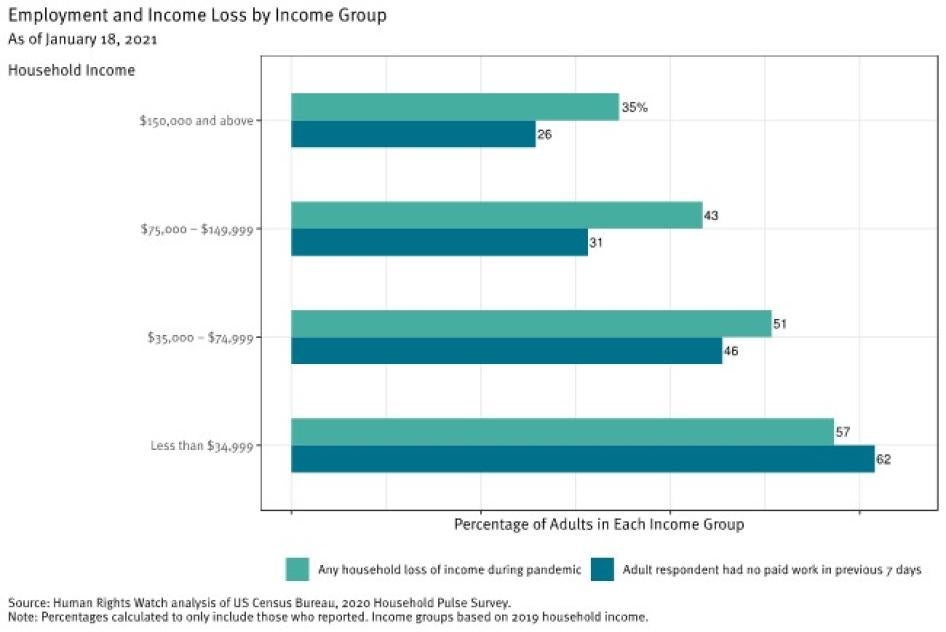

Low-income households were particularly likely to have lost work or income. Among households making less than $35,000 a year, 57.3 percent experienced income or employment loss during the pandemic, compared with 34.6 percent of those making more than $150,000 a year.

States in the US offer varying degrees of support in unemployment benefits. In Mississippi, unemployment benefits are capped at $235 a week. Massachusetts is much more generous, with $855 a week. While differences in maximum benefit levels may be tied to the cost of living in a particular state, without additional weekly payments, even in lower-cost states like Mississippi, benefits are too low to make ends meet.

Even though the unemployment rate fell by more than 40 percent between June 2020 and January 2021 (to 6.3 percent), poverty has increased over the same period, with about eight million more people living in poverty. This disconnect results from some government benefits expiring at the end of July and an increasing number of workers dropping out of the labor market altogether. More than four million people have left the labor force in the past year; two in five of the over 22.3 million jobs lost in March and April 2020 have not returned.

Women have left the labor force at a much higher rate than men. Of the 1.1 million people who left between August and September, over 800,000 were women. Experts suggest that due to the persistent gender earnings gap across spouses and the increase in caregiving burden, women were more likely to drop out of the labor force as schools and childcare centers closed.

One tool to address the unequal labor market results is to extend paid sick days and family and medical leave. As part of the American Rescue plan, the government should enact a paid family and medical leave law to support workers’ health and economic security for the duration of the pandemic, while working to put in place a permanent, national, comprehensive, and inclusive program beyond the pandemic.

Difficulty Paying Household Expenses

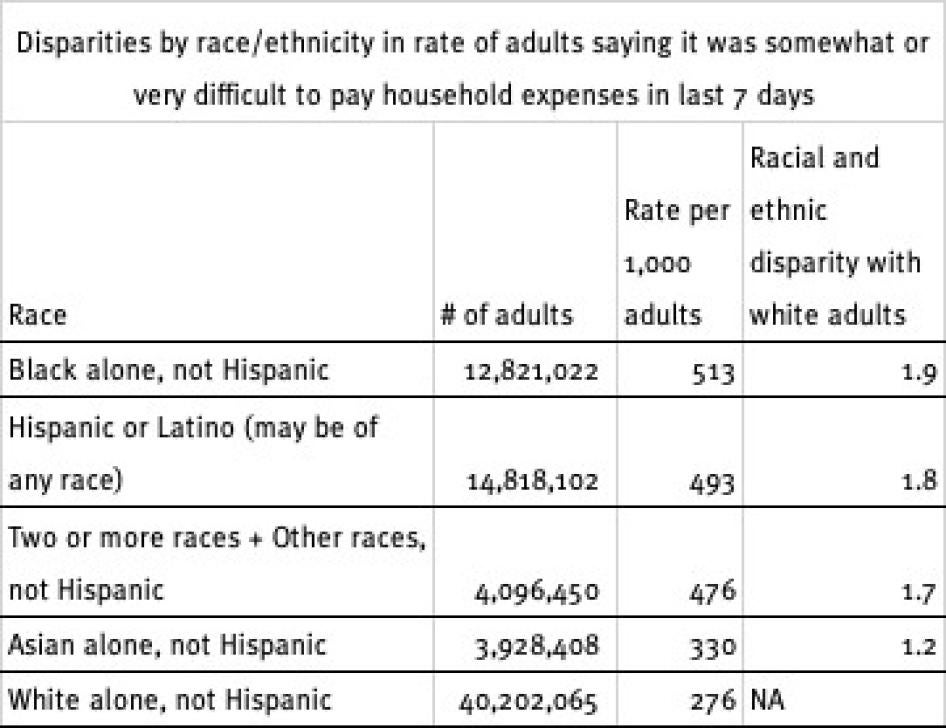

The Census survey examined the disproportionate impact on low-income households and people of color and the ability to pay expenses such as food, rent or mortgage, medical expenses, or utilities within the previous seven days.

About 35 percent of all adults live in households with difficulties paying for their usual household expenses, but this share is highest among those in very low-income households. Nearly 60 percent of households making less than $35,000 a year struggle paying for their usual expenses, suggesting that the impact of the pandemic, including job losses and Covid-19-related morbidity and mortality, is making it harder for many to make ends meet. This share is significantly lower for higher-income households, and lowest among those making more than $150,000 a year.

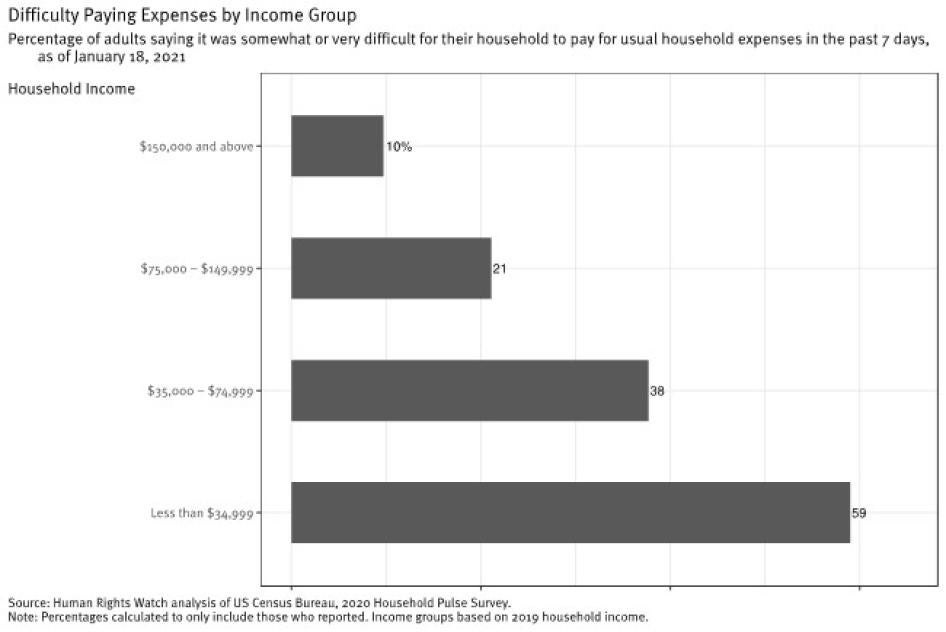

Black and Latinx adults are almost twice as likely as white adults to have difficulties in paying everyday expenses in the previous week.

Food Insecurity

In January 2021, based on the census data, more than one out of 10 adults lived in a home where there was sometimes or often not enough food to eat in the previous week. Racial disparities are high, with Black and Latinx adults living in food-insufficient households at more than twice the rate of white adults.

There is a clear relationship between income and food insecurity. A quarter of adults (nearly 11 million) who live in households with an annual income of less than $35,000 were food insecure in January, the data indicated. Of those with a yearly income between $35,000 and $75,000, 11 percent were food insecure. This share is much lower for households with incomes exceeding $75,000.

Food insecurity was particularly high among households that had lost employment during the pandemic. Three out of four food-insecure households have experienced job loss since the pandemic began and 58 percent did not have work at the time of the survey.

More than half of adults in food-insecure homes have children living with them. Nearly two-thirds of food-insecure families reported that in the previous seven days it was “sometimes” or “often” true that their “children were not eating enough because we just couldn’t afford enough food.” Most of these homes made less than $35,000 in the previous year.

The American Rescue Plan would provide critical investments to address the alarming rates of hunger. It would extend the temporary 15 percent increase in the maximum Supplemental Nutrition Assistance Program (SNAP) benefits from June through September. Benefits should be extended beyond the end of September if the US economy still is not fully recovered, Human Rights Watch said.

A significant portion of people who are receiving SNAP benefits are facing food insecurity. This suggests that the increased benefit may be too low. Among households with SNAP beneficiaries, 27 percent skipped meals in January. According to the Center on Budget and Policy Priorities, one reason is that the US Department of Agriculture’s current interpretation of the emergency food assistance provisions under the Families First Coronavirus Response Act denies those allotments to nearly 40 percent of SNAP households. The federal government should address the immediate needs as well as structural inequities in food insecurity.

In addition, SNAP benefits leave out millions of households in need. There are 16.5 million households skipping meals that are not receiving benefits. About two out of three adults in food-insecure households did not receive food assistance in the previous seven days or have a SNAP beneficiary. Of adults who live in a home where at least one member received free groceries or a free meal in the previous seven days, nearly a quarter still did not have enough food that week.

If strict eligibility criteria or interpretations of who receives SNAP benefits fail to provide food assistance to all in need, putting cash directly into people’s pockets provides important relief. Thirty-three percent of adults who responded to the US Census Bureau Pulse Survey said they used the second stimulus check to pay for food.

Tax credits are another vehicle to help people in economic distress. The child tax credit proposed in the American Rescue Plan would help food-insecure households with children.

It would send $300 monthly checks to low-income parents with children younger than six years and $250 for each child between the ages of six and 17. In providing these benefits, the government needs to ensure that households that don’t file federal income taxes are not excluded.

Precarious Access to Housing

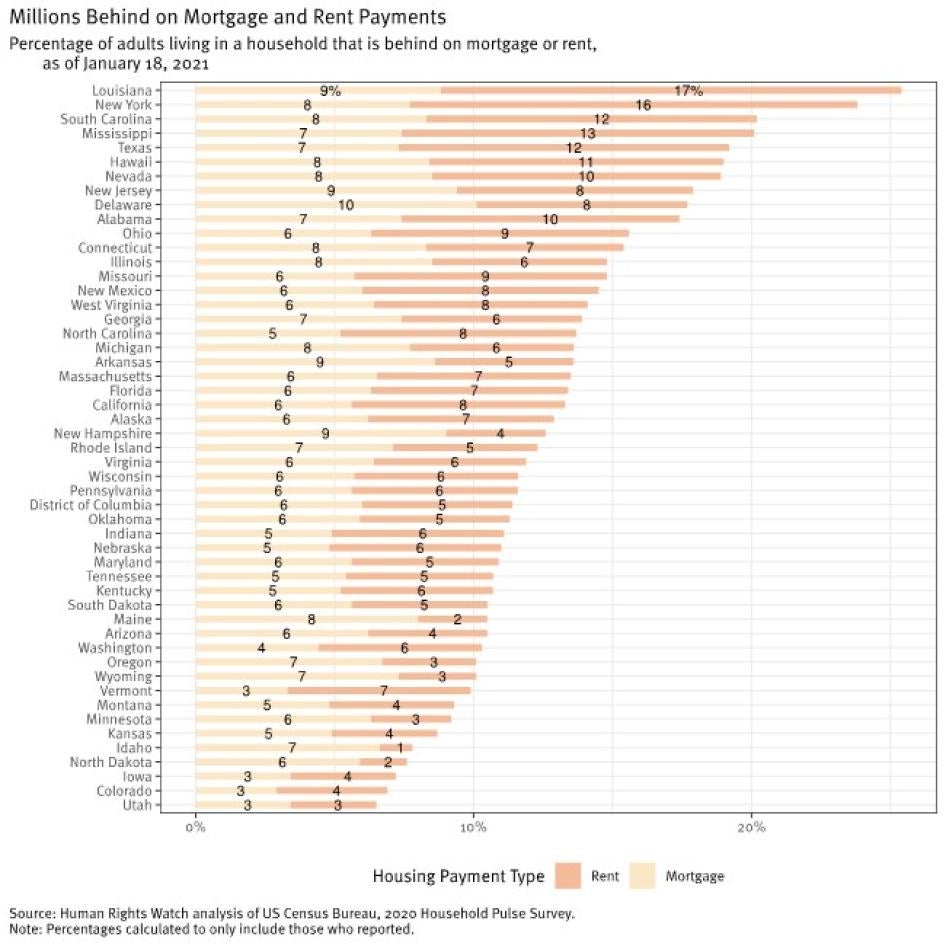

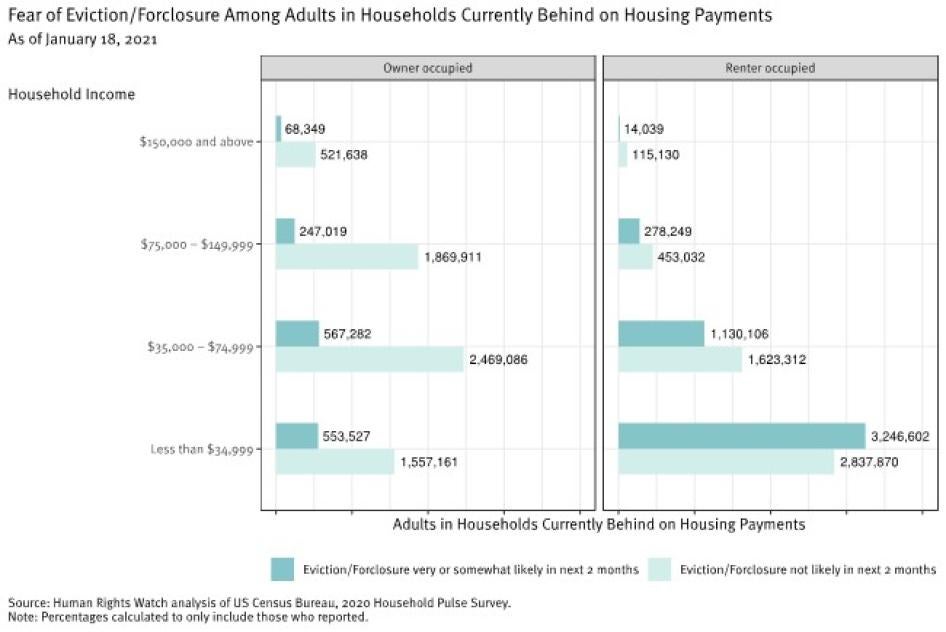

Housing costs, the largest expense item for most households, are becoming increasingly untenable for many. In January, 19 million adults reported living in households that are behind on rent or mortgage payments. Of those, 35 percent, or almost seven million people, said they fear being evicted or foreclosed on in the next two months, according to recent Census data analyzed by Human Rights Watch.

Precarious access to housing, which includes both delays in housing payments and the risk of eviction or foreclosure, risks people’s right to adequate housing. In January 2021, over 19 million adults lived in a household that was behind on rent or mortgage payments, the data indicated. This is a problem throughout the country. In 41 of the 50 states and Washington, DC, at least 10 percent of adults are behind on housing payments. Louisiana and New York report particularly high rates of households at risk with almost a quarter of households behind on housing payments in January.

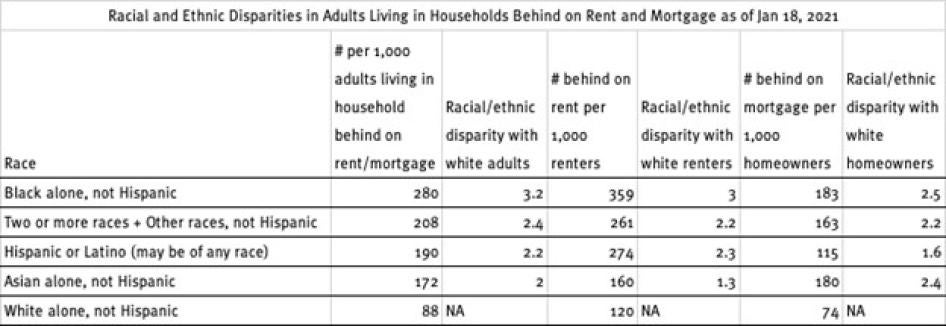

There is a clear racial disparity in payment delays. Black adults are over three times more likely than white adults to live in a household behind on housing payments.

Housing insecurity is highest among low-income households. Of households earning less than $35,000 in 2019, 26 percent are behind on their housing payments, compared with four percent of those making more than $150,000. The proportion of income spent on housing varies depending on income level. In 2019, households in the bottom 20 percent of income levels spent about 40 percent of their annual income on housing. Among higher earners, that proportion is closer to 30 percent.

In addition to falling behind on housing payments, renters and homeowners reported trouble paying utility bills, racking up significant debts. The Urban Institute estimates that almost one in three Black renters (28.9 percent) and 25.9 percent of Latinx renters reported problems paying their utility bills in the previous 30 days, compared with 9.2 percent of white renters. In California, at least 1.6 million households have water debt, and unpaid water bills total $1 billion.

The Census Bureau asked people who are behind on housing payments about their perceived housing security. In January 2021, about 35 percent of adults behind on payments said that it was very or somewhat likely their household would need to leave their home in the next two months because of eviction or foreclosure.

The American Rescue Plan would extend the federal moratorium on evictions that will otherwise expire in March through September and will fund legal assistance programs to help those facing eviction. However, it does not correct flaws in existing state and federal eviction moratoriums, which put millions of tenants at risk of eviction. In addition to an extension of the federal moratorium on evictions, there should be a national moratorium on shutoffs of water, electricity, broadband, and heat for inability to pay, Human Rights Watch said.

The severity of housing insecurity shows that additional support is needed to keep people from being evicted or being without a place to live. Researchers on houselessness state that it is too soon to know how trends have changed during the pandemic but have pointed out that was already on the rise pre-pandemic. The authorities need to do more to meet government obligations to guarantee everyone’s right to affordable, stable, and habitable housing, regardless of a person’s income.

Multiple Stress Factors Contributing to Financial Hardship

Low-income households are at a particular disadvantage in recovery, because many experience multiple stress factors potentially harmful to people’s rights, such as food insecurity, during the pandemic.

Tens of millions of households are estimated to be facing multiple stress factors simultaneously, including no work in the previous week, income loss, food and housing insecurity, or symptoms of depression. Low-income households are particularly prone to compounded layers of stress factors. One in nine adults living in households with an annual income below $35,000 experienced at least one of the five stress factors; 60 percent experienced at least two, and 30 percent struggled to manage three at the same time. Concurrent stress factors are much less frequent among highest earners, with only 18 percent currently experiencing more than one stressor.

People of color are also more likely to experience overlaying stress factors. Close to 45 percent of Black and Latinx adults live in a household that faces multiple stressors, compared to 30 percent of white and Asian adults.

Impact of Raising the Minimum Wage on Economic Hardship and Insecurity

Adjusting the minimum wage to $15 an hour, as is proposed in the American Rescue Plan, could be very effective for combating poverty and inequality and a necessary step to ensure that everyone can enjoy their right to an adequate standard of living. It is an essential measure for addressing racial economic disparities and inequality since workers of color, especially women of color, make up a disproportionate share of low-wage workers. Sixty-three percent of Latinx workers and 54 percent of Black workers earn low wages, compared with 36 percent of white workers.

Even before the pandemic, the labor market was deeply unequal. The share of national income going to the bottom half of the income distribution has fallen by more than one-third since 1970. The share going to the top one percent has nearly doubled.

Many low-wage workers face difficulties meeting their basic needs. The Brookings Institution found that in 2019, approximately 53 million workers between 18 and 64, about 44 percent of all workers, were in low-wage jobs. Their median hourly wage was $10.22, and median annual earnings were about $18,000, which would put a family of three below the federal poverty line of $21,960.

As part of the American Rescue Plan, the Biden administration proposed raising the federal minimum wage to $15 per hour over the next five years. The minimum wage has been frozen at $7.25 since 2009. Researchers at the Economic Policy Institute (EPI) estimate that a $15 minimum wage would raise pay for nearly 32 million workers while reducing government expenditures on public assistance programs between $13.4 and $31 billion.

Most workers who would benefit from a $15 per hour minimum wage are essential and frontline workers. The Congressional Budget Office estimates that in an average week in 2025, when the minimum wage would reach $15 per hour, the number of people in poverty would be reduced by 0.9 million people, and employment would be reduced by 1.4 million workers. A raft of other recent research indicates minimal risk of widespread job losses.

Avoiding Austerity at the State and Local Level that Would Harm Rights

The pandemic has created a severe budget crisis for state and local governments, as tax revenue has dropped and demands for public health and social protection increased. Nineteen states reported making mid-year spending cuts in 2020 due to revenue shortfall. Adjusted spending meant that 1.3 million in state and local employment was lost since February 2020, with large burdens on women and Black workers, who make up a higher share in the state and local government workforce.

Budget cuts that are damaging to human rights have already begun as well. Twenty-three states reported using targeted spending cuts; eight states used across-the-board cuts to balance budgets for 2021. The largest spending reduction was in K-12 education. In Georgia, policymakers approved a 10 percent budget cut for 2021, including a nearly $1 billion cut for K-12 public schools and cuts to programs for children and adults with developmental disabilities, among others. Maryland enacted $413 million in emergency spending cuts, including large cuts to colleges and universities.

The Biden administration’s proposal includes much-needed state and local government fiscal relief. Without more federal aid, many states will likely face hard budget choices, increasing the likelihood of another round of job cuts or austerity for services essential to realizing human rights.