Summary

The Covid-19 pandemic has demonstrated the fragility of global supply chains and the vulnerability of people working at the bottom of these supply chains. In the mining sector, the pandemic has had devastating effects on workers and communities around the world. In some parts of Africa, Asia, and Latin America, small-scale mining activity has been reduced or halted due to lockdowns and blocked trade routes. Where mining has been suspended, mine workers and their families have lost their income. Where mining has continued, workers and affected communities have been exposed to increased risks to their human rights. In some small-scale mining areas, child labor has risen.

In addition, some illegal mine operators and traders have made use of the Covid-19 pandemic to expand their unlawful small-scale mining activities. Illegal gold mining in Africa and Latin America threatens the environment and rights protections, especially the rights of Indigenous peoples. And while lockdowns have been important in combatting the spread of the pandemic, they have also hampered government monitoring and enforcement of mining and labor rights standards. Finally, industrial mines have become hotspots for Covid-19, including the world’s deepest gold mine, located in South Africa.

The Covid-19 pandemic has also posed vast challenges for the jewelry and watch industry, a major market for gold, diamonds, and other minerals. Jewelry companies have had to close stores, and consumer demand has slumped. Companies that were investing in responsible sourcing have diverted attention and resources to more immediate crisis management measures. But now more than ever, because of the increased risk of abuse, jewelry companies should conduct human rights due diligence to ensure that they do not cause or contribute to rights abuses in their supply chains. To achieve this they should comply with the United Nations Guiding Principles on Business and Human Rights (the “UN Guiding Principles”) and a sector-specific norm for mineral sourcing, the Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas by the Organization for Economic Development and Cooperation (the “OECD Minerals Guidance”). Such human rights due diligence should include steps to prevent and address environmental harm and risks from climate change, given their foreseeable impact.

This report scrutinizes and ranks 15 major jewelry companies for their efforts to prevent and address human rights abuses in their gold and diamond supply chains between 2018 and 2020, following up on Human Right Watch’s 2018 report, “The Hidden Cost of Jewelry.” The report also assesses the role of broader industry initiatives, including certification standards.

The 15 companies featured in this report have been selected to include some of the industry’s largest and best-known jewelry and watch companies from different markets: Boodles (United Kingdom), Bulgari (Italy), Cartier (France), Chopard (Switzerland), Chow Tai Fook (Hong Kong), Christ (Germany), Harry Winston (United States), Kalyan (India), Mikimoto (Japan), Pandora (Denmark), Rolex (Switzerland), Signet (United States), Tanishq (India), Tribhovandas Bhimji Zaveri Ltd. (TBZ)(India), and Tiffany & Co. (US). Thirteen of the companies were first assessed by Human Rights Watch in 2018 and have been evaluated for their progress made since publication of our initial report. Two companies, Mikimoto and Chow Tai Fook, were added to this assessment to extend the report’s geographic scope to Japan, Hong Kong, and China. While these 15 companies are not representative of the entire industry, collectively they generate more than US$40 billion in annual revenue, about 15 percent of global jewelry sales.

Overall, the report finds that there has been some progress in individual company practice and in industry standard-setting since 2018. Still, most companies assessed fall short of meeting international norms, and existing certification schemes lack rigor and transparency. In short, much more needs to be done to assure consumers that the jewelry they buy is sourced responsibly.

On the positive side, 11 of the 15 companies assessed have taken some steps to improve their human rights due diligence since the publication of our 2018 report. Eight of the fifteen companies assessed in this report have taken some steps to enhance traceability of their gold or diamonds. Some have opted to source only recycled gold, thus avoiding risks related to mined gold of unknown origin. Several companies have strengthened their supplier codes of conduct, more rigorously screened their suppliers, or published their requirements of suppliers for the first time. Some now publicly identified their suppliers. In addition, 10 companies assessed have taken steps to disclose publicly more information on their due diligence in ensuring respect for human rights. While the steps taken by individual companies vary greatly, and some companies are still performing poorly, these efforts demonstrate progress.

Several industry initiatives have also progressed since 2018. For example, the Responsible Jewelry Council (RJC), the main jewelry industry association, has brought its main certification standard in line with the OECD Minerals Guidance. The Fairtrade and Fairmined Gold standards, which have successfully certified artisanal and small-scale gold mines, are popular with small jewelers and some bigger companies. A new, robust standard for responsible mining has been launched by the Initiative for Responsible Mining Assurance. In addition, several industry initiatives are underway to use technology—such as blockchain and laser technology—to ensure full traceability of diamonds and other minerals. Overall, many players in the sector are recognizing the need to respond to increased consumer demand for responsible and transparent sourcing, as well as to demands and requirements by governments for responsible company conduct.

On the negative side, some of the companies have serious gaps in their due diligence on human rights and transparency. For example, most jewelry companies are still not able to trace their gold and diamonds to the mines of origin. Many do not conduct thorough human rights assessments or mitigation measures regarding conditions at the mines of origin or elsewhere in the supply chain. This is a serious gap, given the legacy of human rights abuses in gold and diamond mining generally, and the renewed human rights risks linked to the Covid-19 pandemic. In the context of the pandemic, few companies appear to have reassessed their supply chains for renewed risks, or actively taken steps to protect the rights of workers in their supply chains. Most companies also do not report on their due diligence efforts to respect human rights in detail. Notably, the vast majority of companies assessed do not report on the human rights risks identified, mitigating actions taken, or non-compliances found. None publish audit reports.

Furthermore, four companies assessed disclose almost no information to the public about their approach to responsible sourcing. This lack of transparency contravenes international norms and standards on best business practice, and diverges from the industry trend described above. When companies do not disclose any information about their practices, it becomes impossible for consumers, the general public, or affected mining communities to assess their actions, and corporate accountability is harder to establish.

Although certification standards should set a high standard, they have not always done so. For example, standards by the main jewelry industry group, the RJC, or the Kimberley Process Certification Scheme and the World Diamond Council’s System of Warranties Guidelines do not require full traceability, transparency, or robust on-the-ground human rights assessments from their members. Third-party audits of jewelry supply chains are often conducted remotely, and auditors sometimes lack human rights expertise. While some industry standards, such as the RJC and the London Bullion Market Association (LBMA), require companies to report about their human rights due diligence efforts, they do not mandate the publication of audit reports or instances of non-compliance found. Their own implementation and certification processes lack transparency, too: The roll-out of the 2019 RJC standard, for example, is planned over a multi-year period, and its certification process is opaque. About 30 percent of RJC members also have the reputational benefit of being members without having completed certification.

Voluntary standards can play a role in generating dialogue and supporting companies that seek to develop best practice. But they cannot replace legal requirements, as our findings confirm. Ultimately, only mandatory human rights due diligence rules—laws—will create a level playing field and move the whole industry in the right direction.

***

For this report, Human Rights Watch sent letters to the 15 companies profiled, requesting information about their policies and practices in relation to human rights due diligence and the sourcing of their gold and diamonds. Nine companies responded in writing to Human Rights Watch’s letters requesting information regarding their policies and practices with regard to sourcing: Boodles, Bulgari, Cartier, Chopard, Chow Tai Fook, Pandora, Signet, Tanishq, and Tiffany & Co. The company responses varied widely, with some providing detailed information on their policies and practices in writing, while others provided only general information on their approach to sourcing. Five companies that responded to Human Rights Watch also spoke to us via conference call: Boodles, Bulgari, Pandora, Signet, and Tiffany & Co. Human Rights Watch also requested information from these companies regarding their response to Covid-19. Six companies did not reply to several requests for information on their Covid-19 response: Christ, Harry Winston, Kalyan, Mikimoto, Rolex, and TBZ.

We assessed the companies for their human rights due diligence measures taken between 2018 and 2020, based on the information provided to Human Rights Watch directly, as well as publicly available information. Since very little information was available on Kalyan, Mikomoto, Rolex, and TBZ, we could not rank these four companies. Below is the ranking that summarizes our findings:

To move forward, all jewelry companies need to put in place strong human rights safeguards—otherwise, they risk contributing to human rights abuses. In particular, companies should:

- Put in place a robust supply chain policy that is incorporated into contracts with suppliers and available to the public;

- Establish chain of custody over gold and diamonds by documenting business transactions along the full supply chain back to the mine of origin, including by requiring suppliers to share detailed evidence of the supply chain;

- Assess human rights risks throughout their supply chains;

- Respond to human rights risks throughout their supply chains;

- Check their own conduct and that of their suppliers through independent third-party audits (a systematic and independent examination of a company’s conduct), and through reliable, accessible, and independent community- and operational-level grievance mechanisms;

- Publicly report at regular intervals on their human rights due diligence, including risks identified;

- Publish the names of their gold and diamond suppliers; and

- Source from responsible, rights-respecting artisanal and small-scale mines, and support initiatives seeking to improve human rights conditions in artisanal and small-scale mines.

Certification schemes and responsible sourcing initiatives—including the Responsible Jewellery Council and the World Diamond Council—should set and uphold a high industry standard and ensure they do not give legitimacy to companies that do not deserve it. Such initiatives should:

- Require companies to adhere to international human rights and humanitarian law;

- Require companies to disclose information on their suppliers, human rights due diligence conducted, audit summary reports, and grievances received and addressed; and

- Ensure that companies are checked for compliance through thorough audits by human rights experts;

- Sanction companies that fail to adhere to the standard, including by withdrawing certification and membership; and

- Ensure that civil society groups and industry representatives have equal decision-making powers and are represented equally on the board of directors and other key bodies.

As governments develop legislation on supply chain due diligence, they should require proper human rights assessments, prevention, mitigation, and remedy, and full transparency in supply chains. Membership in a certification standard, such as the RJC or LBMA, should not automatically exempt companies from their obligations or penalties under the law, as is currently planned or debated in several jurisdictions.

I. Abuses in Mining and the Impact of Covid-19

A Legacy of Human Rights Abuses in Gold and Diamond Mining

Around the world, people living near or working at gold and diamond mines have for many years suffered serious human rights abuses, including those stemming from large-scale environmental destruction. An estimated 40 million people work in artisanal and small-scale mining, and an additional 100 million people indirectly depend on the sector for their livelihoods.[1] Artisanal and small-scale mines operate with little or no machinery and often belong to the informal sector. By comparison, around seven million people work globally in industrial, large-scale mining operations.[2]

Basic labor rights are violated in the context of artisanal and small-scale mining. For example, young children have worked in small-scale gold or diamond mines, often at the expense of their education. Disregard for health and safety standards has resulted in mining accidents, injuring and killing child as well as adult miners.[3] Miners have also been subject to trafficking or forced labor in both small-scale and industrial mining.[4]

Gold and diamond mining operations have polluted the environment, contributed to global carbon emissions, and threatened people’s rights to health, water, food, and a healthy environment. Large-scale industrial mines in particular have caused environmental damage and ill-health through the improper management of tailings (mine residue), the release of toxins from mineral processing, and accidents.[5] Small-scale gold mines often rely on mercury for gold processing and emit over 800 tons of mercury a year, exposing millions of people to this highly toxic substance.[6] Mercury attacks the central nervous system and can cause serious, irreversible health conditions, disability, and death; children are especially at risk.[7]

Mining operations have also threatened the rights of Indigenous peoples. For example, large-scale mining companies have reportedly cleared land for exploration and mining without seeking prior and informed consent from Indigenous communities living nearby.[8] Activists opposing mining, including Indigenous peoples, have allegedly been threatened or killed.[9]

Local residents have sometimes become victims of violent abuses by states security forces, private security personnel, or non-state armed groups.[10] In situations of armed conflict, gold and diamond companies have been directly linked to violations of international humanitarian law. In particular, gold and diamond mining and trade have helped finance abusive armed groups, including through money-laundering.[11] Abusive government armed forces and government-allied militias also have benefited from mining in countries such as Zimbabwe, Sudan, and South Sudan.[12]

|

Venezuela: Brutal Abuses in Gold Mines Taint Gold Supply Chain

In Bolívar State in Venezuela, Venezuelan armed groups known as “syndicates” and Colombian armed groups control illegal gold mines and spread terror among residents and miners. The armed groups largely operate with government acquiescence and, in some cases, with the direct involvement of the army. Some of the gold produced is sold to Venezuela’s Central Bank, but much of it is reportedly smuggled out of the country to countries including Turkey, the United Arab Emirates, and Switzerland.[13] In 2019, Human Rights Watch interviewed miners and residents, and documented horrific abuses by armed groups, including punitive amputations and torture.[14] In the worst cases, syndicates have dismembered and killed alleged offenders in front of other workers. “Everyone knows the rules,” one resident said. “If you steal or mix gold with another product, the pran [the syndicate leader] will beat or kill you.” Four residents said that they witnessed members of syndicates amputating or shooting the hands of people accused of stealing. A 17-year-old boy said he witnessed syndicate members individually amputating each finger of a miner accused of stealing gold, before amputating the remains of both hands. He said they did it in front of other mine workers so “everyone could see.”[15] The illegal mining operations also devastate the environment and harm workers’ health. Residents are exposed to mercury, which miners use to extract the gold. Residents described harsh working conditions in the mines, including 12-hour shifts, lack of protective gear, and children as young as 10 working alongside adults. During the Covid-19 pandemic, the gold mines have continued to operate, although gasoline shortages have made it harder to move around. Border closures have led to an increased use of unofficial crossings to transport gold.[16] A comprehensive report released by the United Nations Office of the High Commissioner for Human Rights in July 2020 documented similar abuses.[17] |

|

Zimbabwe: Diamonds Still Certified Despite Abuses

In the Marange diamond fields of eastern Zimbabwe, residents have suffered serious human rights abuses related to diamond mining for many years.[18] Nonetheless, the Kimberley Process, an intergovernmental certification scheme for diamonds, allows diamonds from Marange to be exported. In 2018, security forces in Marange beat and otherwise abused residents after protests against mining turned violent; three children were hospitalized. Many residents feel harassed by authorities who have declared Marange a “protected area” that can only be visited with special authorization. Security forces have arrested several people caught without an identity document proving their residency.[19]

During 2018 and 2019, private security officers employed by the state-owned Zimbabwe Consolidated Diamond Company (ZCDC) have used violence to deter local residents from mining diamonds, according to victims. In several cases, ZCDC security personnel have set dogs on men accused of mining illegally, injuring and even killing some of the men.[20] One of the miners described his arrest: “The guards handcuffed me and my colleagues and ordered us to sit down. They set vicious dogs on us which mauled us for about 10 to 15 minutes as they watched, leaving us severely injured.”[21] Since the outbreak of Covid-19, the Zimbabwean government has declared mining an essential service and allowed operations to continue. This has caused concern among trade unions and NGOs who have called for better protections for mine workers at the ZCDC and Anjin diamond mines in Marange.[22] Illegal small-scale diamond mining and diamond smuggling to Mozambique has continued during the pandemic, and soldiers have continued to raid and arrest artisanal miners according to an NGO report.[23] |

Impact of the Covid-19 Pandemic on Mine Workers and Mining Communities

The Covid-19 pandemic has had a devastating effect on the human rights of mine workers and communities. At the same time, government monitoring and enforcement have decreased or even been suspended, and in a few countries, governments have rolled back environmental and mining-related regulations.[24]

Covid-19’s Effect on Artisanal and Small-scale Mining

The Covid-19 pandemic has severely affected small-scale mining and trade. In some parts of Africa, Asia, and Latin America, small-scale mining activity has been reduced or ground to a halt altogether due to lockdowns and blocked trade routes.[25] In other areas, unregulated small-scale mining has continued or even expanded, and sometimes child labor has increased. At the same time, government monitoring and enforcement of mining and labor rights standards have been hampered by lockdowns.

In producing countries, prices for minerals from small-scale mines have crashed because local traders faced difficulties in selling minerals abroad.[26] Gold prices dropped 40 percent or more in some countries, even as international prices reached their highest point in years as investors bought up gold as a “safe” asset; local diamond prices also fell sharply.[27]

As small-scale mining operations and trade were severely curtailed, millions of households lost their income and struggled to meet their basic needs, including food, water, and housing.[28] As a result, child labor has increased in some areas where mining still occurs. For example, surveys by an independent research group found an increase in child labor in artisanal gold and diamond mining sites in the Central Africa Republic, as well as in artisanal gold mining sites in the Democratic Republic of Congo since the start of the Covid-19 pandemic.[29] Observers of the mining sector have noted the risk for increased child labor in mining in other countries, and the UN has rung the alarm bell over risks of higher rates of child labor globally due to the pandemic.[30]

There has also been an increase in illegal gold and diamond mining and trading in several countries in Africa and Latin America, in part due to restrictions on the legal movement of resources and reduced government monitoring of laws and regulations.[31] As a result, mining communities are at heightened risks of exploitation, abuse, and environmental damage by illegal mining operators.

For example, a civil society activist in Guinea said that illegal diamond mining has risen, as security forces were no longer monitoring mining activities during the lockdown.[32] Observers in Ghana noted a similar increase in illegal gold mining, including in rivers and forest reserves, as state control and monitoring of mining areas were drastically reduced due to lockdown rules.[33] In East and Central Africa, while many trading houses shuttered, illicit trading networks thrived.[34] Traders travelled to the Democratic Republic of Congo (DRC) and Uganda to export gold from there, and illicit gold exports were reported to continue from the DRC through Uganda to the gold-trading hubs of Dubai and Istanbul.[35] This illegal trade can exacerbate economic exploitation of local workers, money-laundering, and violence in conflict-affected countries such as Congo.[36]

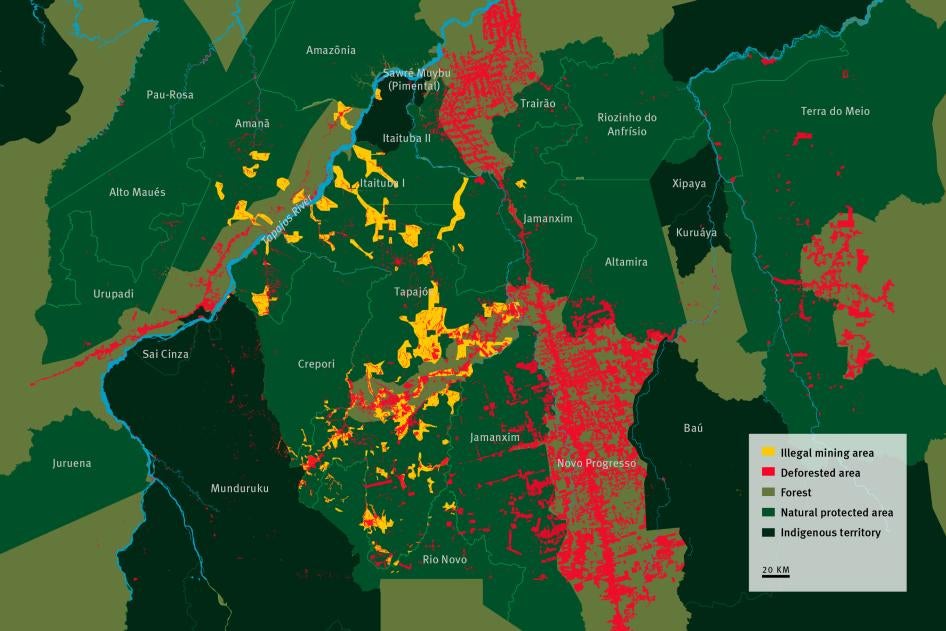

In the Brazilian Amazon, illegal gold mining sites have continued to operate despite the lockdown, raising concerns around the potential spread of Covid-19 to vulnerable Indigenous groups.[37] Indigenous leaders, local organizations and federal prosecutors have reported illegal mining along the Tapajos River and miners encroaching on Yanomami’s indigenous territory.[38] In July 2020, the Inter-American Commission for Human Rights issued precautionary measures in favor of the Yanomami and specifically mentioned the threat from mining.[39]

Impact of Covid-19 on Large-Scale Mining

Large-scale mining companies continued to operate in many countries around the world after the onset of the pandemic. Several governments, including Argentina, Australia, Brazil, Canada, Ghana, South Africa, and Zimbabwe explicitly declared these operations as essential services.[40] Where industrial mines reduced or halted operations, they did so for a limited period.[41] By July 2020, most mines had resumed operations.[42]

The continuation or resumption of mining operations has caused concern for the health of mine workers among trade unions and civil society groups.[43] Industrial mines can easily become hotspots for contamination as workers often work close to each other in confined spaces. Migrant workers also often live together in crammed hostels and risk spreading the virus when travelling between their home community and their workplace.[44] A case in point is the world’s deepest gold mine, Mponeng, in South Africa. The mine, owned at the time by AngloGold Ashanti, had to suspend operations in late May 2020 because 196 workers had tested positive for the coronavirus.[45]

The World Health Organization has given detailed guidelines to companies on steps they should take to protect workers from the pandemic, for example by providing personal protective equipment.[46] Yet, efforts by some companies have sometimes been inadequate, according to civil society groups and unions.[47]

Restrictions on public gatherings have made it more difficult in some countries to protest against mining-related impacts; in addition, community consultations have been moved online, making community participation harder.[48] Civil society groups have also reported numerous attacks on those opposing mining during the pandemic, including arrests and killings.[49] In Ecuador, for example, a mayor and other municipal government officials were detained in May 2020 after they protested the decision of the central government to allow gold mining in their area.[50]

II. International Standards

The human rights responsibility of companies is articulated in the 2011 UN Guiding Principles on Business and Human Rights (the “UN Guiding Principles”).[51] Under the UN Guiding Principles, businesses have a responsibility to ensure that they are not causing or contributing to human rights abuses in their global supply chains. They are expected to put in place so-called human rights due diligence measures— that is, a process to identify, prevent, mitigate, and account for companies’ impacts on human rights—throughout their supply chain. Businesses should monitor their human rights impact on an ongoing basis and have processes in place to remediate adverse human rights impacts they cause or to which they contribute. This should include environmental harms and climate-related risks that have human rights consequences. Businesses are also required to report on their progress externally.[52] Although some companies engage in philanthropy outside their own operations, such charitable endeavors are largely unrelated to their human rights responsibilities under the UN Guiding Principles.[53]

The Organisation for Economic Co-operation and Development (OECD) has spelled out these requirements further in its Due Diligence Guidance for Responsible Business Conduct, as well as in a sector-specific guidance for the mineral supply chain, the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (the “OECD Minerals Guidance”).[54] The OECD Minerals Guidance builds on the concept of human rights due diligence developed in the UN Guiding Principles. It lays out five steps for risk-based due diligence in the minerals supply chain, including jewelry companies: 1) strong management systems, including systems to establish chain of custody; 2) identification and assessment of risks in the supply chain; 3) a strategy to respond to identified risks; 4) third-party audits of supply chain due diligence; and 5) public reporting on supply chain due diligence.

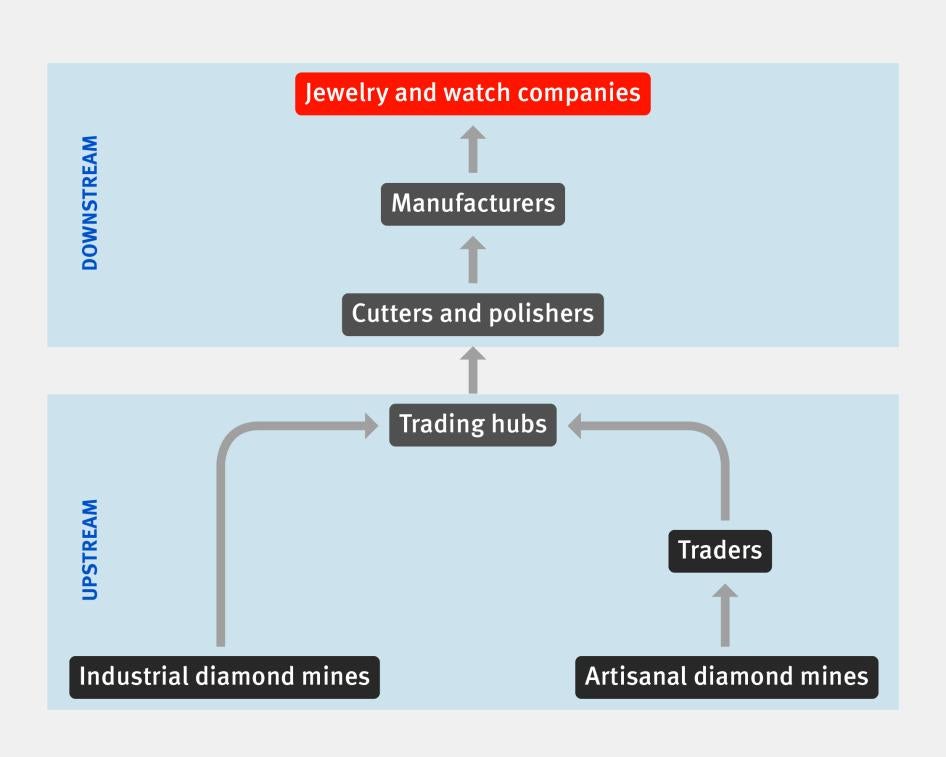

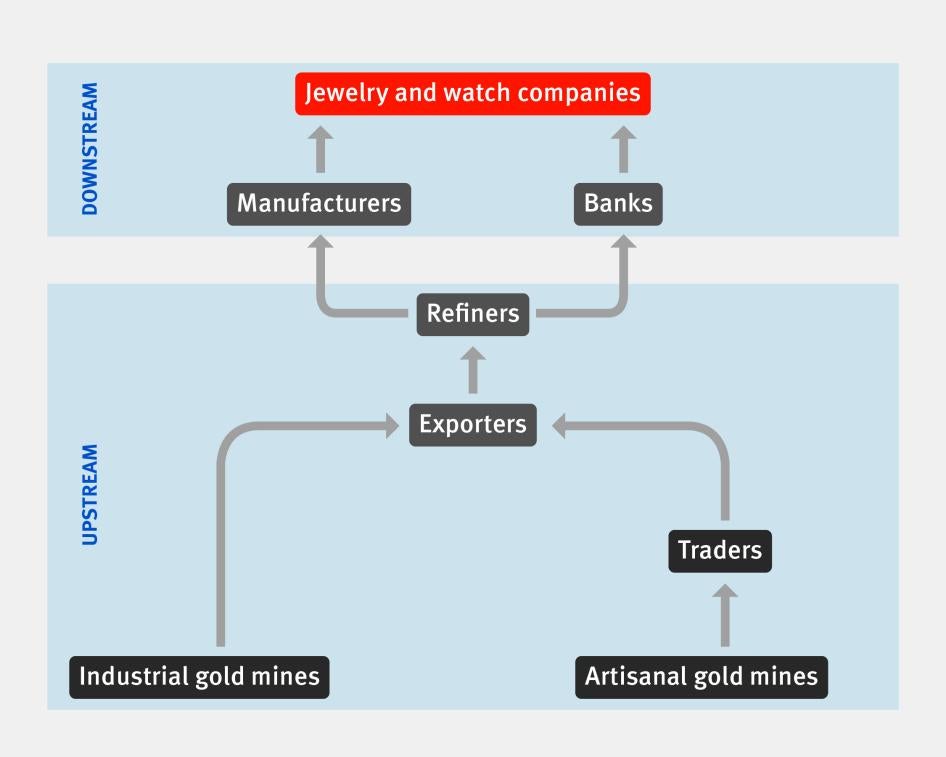

The OECD Minerals Guidance applies to the sourcing of all minerals, including diamonds, and implicates a broad range of human rights. It is not limited to conflict regions but applies to all areas that are “high-risk,” such as areas of political instability, repression, institutional weakness, insecurity, collapse of infrastructure, widespread violence, violations of national or international law, or “other risks of harm to people.”[55] The OECD Minerals Guidance also applies to all actors in the supply chain; for gold, it distinguishes between “upstream” companies such as mines, gold traders in the country of origin, and international gold refiners, and “downstream” companies, such as international gold traders, bullion banks, jewelers, and other retailers.[56]

From January 2021, a new European Union minerals regulation will make compliance with the OECD Minerals Guidance a legal requirement for EU importers of gold and three other minerals (tin, tantalum and tungsten).[57] The regulation directly applies to EU importers of the four metals, but will also have an impact on refiners and smelters who supply the importers; the EU will draw up a list of refiners and smelters considered “responsible.” While the regulation does not apply to downstream companies such as jewelry companies, such companies are still “expected to use reporting and other tools to make their due diligence more transparent, including, for many large companies, those in the non-financial reporting directive.”[58]

Money-laundering, fraud, bribery, and tax evasion have been connected to human rights abuses in the mineral supply chain, and measures against financial crime are part of the OECD Minerals Guidance. A more detailed international norm on anti-money laundering measures is the guidance of the Financial Action Task Force, the global regulator against illicit financial transactions.[59] Its 40 general recommendations apply to all industries and define measures for the criminal justice system, law enforcement, the financial system, and international cooperation. In addition, the Financial Action Task Force issued specific guidance documents on the diamond and gold supply chains.[60]

II. Jewelry Industry and the Pandemic: Threats and Opportunities

The Covid-19 pandemic has posed vast challenges for jewelry brands and has drawn attention and resources away from human rights due diligence efforts to more immediate crisis-management measures. At the same time, some jewelry industry representatives have told Human Rights Watch that human rights due diligence remains a key component of successful business and that responsible business conduct is crucial, perhaps even more necessary, at times of a pandemic.[61] Observers have noted that companies focused on responsible business conduct may be more likely to weather the economic crisis than others.[62] Indeed, companies that embrace responsible sourcing may be most likely to rebound successfully from the Covid-19 crisis, as consumers attach increasing importance to responsible business conduct.

Impact of Covid-19 on Jewelry Brands

In response to widespread lockdowns and guidance from health authorities, global brands began closing their retail stores in China in January 2020 and, by mid-March, across most of Europe and North America. Travel restrictions and lockdown rules prevented mining companies, traders, manufacturers, and other businesses in the jewelry supply chain from shipping their products. At the same time, consumer spending decreased dramatically due to job and income losses and economic insecurity linked to the pandemic.[63] Consumers began spending less on non-essential products and in particular, delaying purchases of luxury items. McKinsey surveys of consumers across 12 major global markets from mid-March to early May 2020 found that consumers in all but 1 of the 12 countries surveyed put jewelry among the categories they were least likely to purchase.[64]

Companies in the jewelry supply chain have all been affected. For example, exports of polished diamonds from Belgium, a global diamond hub, dropped by 45 percent in the first quarter of 2020, according to the Antwerp World Diamond Centre.[65] For the first quarter of the year, Chow Tai Fook Jewellery Group Ltd’s sales were down 65 percent in Hong Kong and Macau, and 41 percent in China.[66] Sales for Signet Jewelers, one of the world’s largest diamond retailers, were also down 41 percent for the first quarter of 2020, and in June the company announced it would permanently close 400 stores.[67] As jewelry companies closed stores, some worked to shift sales online.[68]

Workers in jewelry manufacturing, trading, and retail have been affected as companies have shifted to at-home work, reduced work hours for employees, furloughed or laid off workers, and cut salaries. In Surat, India, a global diamond-manufacturing hub, migrant workers in diamond manufacturing were left without pay and jobs after the government lockdown.[69] Diamond cutting businesses in Surat resumed limited operations in late May but suspended them again in July to contain the spread of Covid-19.[70] Government and third-party monitoring of labor standards have been hindered or altogether stopped. In many cases, third-party auditing firms have had to move to “virtual audits” because of the travel restrictions and lockdowns. This environment presents heightened risks that labor abuses would occur altogether unnoticed.[71]

Some jewelry companies made efforts to protect the livelihoods and well-being of their direct employees. Signet launched a relief fund to provide grants to hundreds of employees who experienced financial or other hardships as a result of Covid-19.[72] Tiffany & Co. continued to pay employees, although at a reduced level after a period of time, for certain employees in closed or partially closed locations who were not able to work from home.[73] Pandora guaranteed eight weeks’ salary for store employees after 90 percent of its stores were closed and—remarkably—maintained operations at its main manufacturing facility in Thailand, while instituting safety measures such as social distancing among workers.[74] Pandora’s case is unusual as the company has its own manufacturing factories (meaning it is vertically integrated). Human Rights Watch does not have any information on jewelry brands taking steps to protect workers in supplier factories from the economic impacts of the pandemic.

Some companies pivoted to meet specific Covid-19-related demand. Bulgari, owned by LVMH, repurposed its fragrance factory in Lodi, Italy, to provide hand sanitizer for hospitals in Italy and Switzerland.[75] LVMH, its parent company, has likewise used its labs in France to produce hand sanitizer for French hospitals.[76] Chow Tai Fook used one of its diamond processing factories to manufacture surgical masks.[77]

Consumer focus on transparent and ethical business

Surveys conducted since the start of the Covid-19 pandemic indicate that consumers attach a high value to ethical business, “conscious shopping,” and buying local products, even when overall spending patterns are changing.[78] It is expected that this trend will remain even after the pandemic.

Market analysts agree that there is a heightened focus on sustainability among consumers, particularly millennials and those younger (“Generation Z”). Surveys in 2019 among 3,000 consumers in Brazil, China, France, the UK, and the US found that 75 percent of consumers view sustainability as extremely or very important. More than one-third reported that they had already switched from a preferred brand to another because of the brand’s social or environmental practices, and more than half said they planned to switch brands in the future if another brand is perceived as more environmentally or socially sustainable.[79]

Consumers’ focus on sustainability has created an incentive for companies to show that they have a larger purpose and are acting in an ethical manner.[80] This has helped prompt changes in the garment sector, where more and more companies are revealing which suppliers have produced their clothes or footwear. The Fashion Transparency Index, a tool used by a nongovernmental organization to assess and rank the biggest apparel retailers’ disclosure practices, has found that 35 percent of brands surveyed are now publishing information on their direct suppliers, whereas only 12.5 percent of companies surveyed did so in 2016.[81] This discernible shift in the fashion industry may prompt greater transparency in the jewelry industry as well, particularly as some clothing brands also sell affordable jewelry and list the suppliers who make such accessories.[82]

Traceability Technologies

New technologies in the minerals sector have the potential to enhance traceability and provide consumers with much more reliable information about the geographic origin of the minerals in their jewelry. These traceability technologies could offer an opportunity for improved jewelry sourcing, even though there have also been some concerns.

Laser Technology

Emerging laser technologies can analyze the geochemical qualities of individual diamonds—and in the future, also other minerals—to identify their mine of origin with a high degree of accuracy. For example, Mintek, South Africa’s national mineral research organization, is creating a database of “fingerprints” of rough diamonds from across the African continent.[83] To date, the laboratory has analyzed over 1,080 diamonds from six different African nations, although its technique is currently not suitable for polished diamonds.[84]

Materialytics, a US-based, privately funded company, has developed a similar approach to diamond traceability through laser technology. The process analyzes millions of data points per sample to create a unique signature for each sample, similar to DNA.[85] Applied to diamonds, Materialytics can use this “DNA sequence” to trace a diamond back to its mine of origin with reportedly more than 95 percent accuracy.[86] This technique can be used to establish traceability for both rough and polished diamonds, and is both quick and inexpensive. Materialytics has analyzed thousands of diamonds from 10 different countries and approximately 25 percent of the world’s diamond deposits and is currently working with several retailers to make the technology commercially available in early 2021.[87]

Blockchain

In parallel, a number of initiatives are underway to establish traceability through distributed ledger technology, commonly known as blockchain. Blockchain allows data to be validated and stored as an immutable “block” on a collectively owned and distributed digital database.[88] Blockchain technology builds up a shared database (ledger) in which all actors in the value chain log their activities, thus creating a single source of information for the entire supply chain. The technology can be used in a variety of supply chains, and is being explored in the minerals supply chain, among others.[89]

Several blockchain initiatives are underway for the gold and diamond supply chains, through the collaboration of large jewelry, mining and technology firms.[90] One of them is Trustchain, a consortium including IBM and the Richline Group, a global jewelry manufacturer.[91] In 2018, Trustchain produced a set of six engagement rings that it said were the first finished pieces of jewelry offered for retail sale that had been traced from mine to market using blockchain.[92] Another initiative is Tracr, a blockchain-based tracking program designed to create digital mine-to-consumer records of diamonds. It is being developed by De Beers, in collaboration with other stakeholders, including Signet, Chow Tai Fook, and Alrosa.[93]

Concerns about traceability technology

There is a risk that traceability technologies favor large corporate players and exclude smaller businesses with less technological know-how and resources. In the diamond and gold supply chain, artisanal and small-scale mining operations may not have access to the new technology or reliable internet, or may not be included in relevant mine databases, and as a result could be disadvantaged.[94]

Another concern is that blockchain and laser technology may be misunderstood as tools that automatically deliver responsible business conduct. But traceability initiatives are designed to trace goods, and do not assess human rights risks.[95] To be effective, these technologies need to be accompanied by rigorous human rights assessments to ensure that mines of origin meet responsible sourcing standards.

Finally, the new technologies are only at the development stage, and their practical use still needs to be proven. For example, blockchain data on a ledger may not always be correct, and blockchain systems are expensive to create.[96]

IV. Industry Standards for Responsible Sourcing: Fig Leaf or Assurance

A number of business-led initiatives have developed sector-specific standards with the goal of promoting responsible business conduct in the minerals and jewelry industry. These standards are voluntary—they are not legally binding and companies can choose whether or not to adopt and join the initiative promoting them.

While industry platforms should set the highest standard in the industry, they have often not done so, and in some cases fallen below existing international norms such as the UN Guiding Principles on Business and Human Rights and the OECD Minerals Guidance, which should be treated as the minimum requirement. Some standards, such as the System of Warranties Guidelines for the diamond industry, clearly fall below international responsible business norms and compliance with them would still leave mining communities at risk of abuse. Other standards have more rigorous requirements, but still suffer from substantive gaps and untransparent certification processes. With weaker requirements and without independent verification, voluntary standards can be used by companies as a “fig leaf,” even if this is not the intention of the bodies managing the standards.

Voluntary standards can play a role in generating dialogue and supporting companies that are ready to do more than what is legally required. But they are not fit-for-purpose to reliably detect abuses and hold corporations to account for harm, nor to provide remedies to victims of corporate abuse.[97] Third-party audits have been found to have severe limitations and have repeatedly failed to uncover or address non-compliance, including human rights abuses.[98] While some argue that mandatory human rights due diligence is not needed, our findings confirm that voluntary standards cannot replace mandatory rules. Ultimately, only legislation will be able to create a level playing field and prompt all businesses to conduct robust human rights due diligence.

Standards of the Responsible Jewellery Council

Code of Practices of the Responsible Jewellery Council

The Responsible Jewellery Council (RJC) is the leading jewelry industry association, with over 1,200 member companies along the jewelry supply chain, including small-scale and industrial mines, traders, gold refiners, diamond cutters and polishers, manufacturers, and jewelry retailers. The RJC maintains a certification standard, the Code of Practices (the “Code”) that, in theory, requires all its members to take detailed steps regarding human rights, the environment, and financial integrity in their own operations and with business partners. Members are certified if they are found by auditors to comply with the standard. As of May 2020, the RJC had 888 certified members.

In April 2019, the RJC published a new, revised version of its certification standards. The content of the revised standard is significantly stronger than the previous 2013 version; however, the implementation and certification process remain weak. The revision occurred partly in response to a poor OECD review that threatened the RJC’s ability to be recognized as a valid industry scheme under a new EU minerals regulation.[99]

The new Code represents a significant improvement over the previous standard because it aligns with the OECD Minerals Guidance. Importantly, it also makes clear that the OECD Minerals Guidance applies to all company members in the gold, silver, platinum, diamonds, and colored gemstones supply chains, including diamond companies irrespective of their efforts under the Kimberley Process and World Diamond Council’s System of Warranties Guidelines.[100] The Code is accompanied by a manual with detailed explanations regarding implementation of the OECD Minerals Guidance. In addition, the Code also makes important, positive changes with regards to transparency: It now requires member companies to report publicly about their practices, and to make their supply chain policy public.[101]

Unfortunately, the Code of Practices still has a number of weaknesses. On content, it does not require compliance with several key international human rights instruments, notably fundamental International Labour Organization (ILO) conventions on forced labor, freedom of association, and collective bargaining, as well as Indigenous peoples’ rights. Provisions on waste, emissions, and tailings are very vague.[102] It also does not require companies to establish full traceability for their material.[103]

One of the most serious problems with the Code revolves around implementation. For the new standard, the RJC planned a protracted, multi-year rollout with extra time for diamond and gemstone companies, and a review by 2021 that could potentially lower the existing requirements.[104]

The implementation timeline was designed before the outbreak of Covid-19, so is unrelated to delays caused by the pandemic.[105] The timetable foresees that during the first “transition” year (April 2019-April 2020), members of the RJC coming up for certification could choose whether to be assessed against the new Code or the previous 2013 version. Because certification is for a three-year period, companies that chose the 2013 version may not be required to be audited against the new standard until 2023. Furthermore, diamond and colored gemstone companies have been granted a “pilot period” with additional time to reach compliance, after diamond industry companies or groups pushed for this exception[106]: Between April 2020 and April 2021, companies in the diamond and gemstone supply chain will be assessed for some, but not all of the Code’s requirements—notably, they will not be checked for steps 3 and 4 of the OECD Minerals Guidance which require companies to identify and address human rights risks and undergo a third-party audit. This is problematic, as a mere review of steps 1, 2, and 5 of the OECD Minerals Guidance is unlikely to detect human rights concerns in supply chains. Between April 2021 and April 2022, companies in the diamond and gemstone sector should be fully assessed against the Code, according to the RJC. At the same time, however, the findings of the pilot period will be used to evaluate the Code of Practices, guidance, and audit approach, so further changes may take place.[107] Hence, in theory, companies that have not been assessed against the 2019 Code until April 2021 may not be assessed against the current standard at all. However, when asked about the timetable, the RJC assured Human Rights Watch that diamond and colored gemstone companies are expected to comply with the full five-step framework from 2021.[108]

An audit is a third-party review that examines compliance with a standard’s requirements. The Code of Practices’ provisions around auditing and certification remain weak and opaque. For example, companies are not required to make audit reports or summaries publicly available, nor does the RJC disclose information on the certification process and decision.[109] There is a complaints procedure that could prompt disciplinary proceedings, including loss of RJC membership, but information regarding disciplinary proceedings is confidential.[110]

A related concern is that members are given two years to comply with the standard after joining the RJC, but benefit from the RJC’s reputation by creating the impression that they comply with the organization’s standard in the interim. As of May 2020, about 30 percent of the RJC’s 1256 members were not certified.[111]

Chain of Custody Standard of the Responsible Jewellery Council

The RJC has a separate “Chain of Custody Standard.”[112] A chain of custody is the documental evidence of a product’s supply chain, which allows for the product’s traceability. Chain of custody and traceability are essential for conducting human rights due diligence—if a company does not know where its material is from, it cannot assess or address human rights risks.

The Chain of Custody Standard promotes traceability by ensuring documentation along the supply chain and requiring information on the country of origin for mined gold, silver, and platinum metals.[113] But it does not require companies to trace their metal back to the mines of origin—only to the country of origin— nor does it require companies to make any of that information public or conduct full human rights due diligence.[114] The Chain of Custody Standard also has a provision on recycled material, requiring companies to check on the suppliers’ due diligence process and assess risks.[115]

The RJC’s Chain of Custody Standard is voluntary for members, unlike the Code of Practices, and applies to supply chains for gold, silver, and platinum group metals—but not diamonds. As of July 2020, only 106 of the RJC’s 1,256 members—about 8 percent—were certified against the standard, even though the vast majority of RJC members have at least one of the metals covered by the standard in their supply chain.[116]

Standards for the Diamond Sector[117]

Kimberley Process

The Kimberley Process Certification Scheme is a government-led international certification scheme launched in 2003 to prevent trade in “conflict diamonds.”[118] Under the scheme, member states have to set up an import and export control system for rough diamonds. Both the Kimberley Process and the associated World Diamond Council System of Warranties Guidelines for companies have proven insufficient to ensure robust human rights due diligence in the diamond supply chain.

The Kimberley Process relies on a narrow “conflict diamond” definition that only focuses on rough diamonds sold by rebel groups seeking to overthrow a legitimate government, ignoring a wide range of human rights issues related to state actors or private security firms. Because of this glaring loophole a diamond certified as compliant under the Kimberley Process may still be tainted by abuse. That has happened in the case of diamonds from Zimbabwe and Angola. These diamonds continue to be KP-certified and reach the global diamond market.[119] In addition, the Kimberley Process applies only to rough diamonds, allowing stones that are fully or partially cut and polished to fall outside the scope of the initiative.

Despite much discussion over the need to reform the Kimberley Process, and a third periodic reform process starting in 2017, almost no progress has been made to change the definition to ensure diamonds are abuse-free.[120] Civil society groups, the World Diamond Council, and the government of Canada have unsuccessfully pushed for a widening of the “conflict diamond” definition, but producing and manufacturing countries such as Angola and India have resisted the change “to protect state interests against rebels,” according to a civil society spokesperson.[121] As a result of this and significant concerns with implementation and enforcement, the scheme appears increasingly dysfunctional and has lost credibility as a safeguard against the abusive mining of diamonds.

World Diamond Council’s System of Warranties Guidelines

The World Diamond Council (WDC), a business association for the diamond industry focused exclusively on the KP, has published guidelines for industry self-regulation in order to “strengthen consumer confidence in diamonds” whether in rough or polished form.[122] Its System of Warranties Guidelines are primarily designed to help companies meet and exceed the requirements of the Kimberley Process, though they also include broader language on human rights and anti-money laundering. The System of Warranties Guidelines apply to polished diamonds, which are not covered by the Kimberley Process. They do not have a monitoring, verification, or complaints procedure.

The WDC believes that it has brought “further improvement” to responsible diamond supply chains by revising the System of Warranties Guidelines in 2018.[123] The Guidelines now include language on human rights, for example, broad references to labor rights and discrimination, as well as anti-money laundering standards.

However, the guidelines are weak because they do not make human rights due diligence a clear requirement for members. In the publicly available version of the guidelines, human rights and labor rights issues are described as “voluntary.”[124] Members are only “encouraged” to avoid causing or contributing to abuses and to “educate themselves on” rather than implement the OECD Minerals Guidance. The Guidelines also lack any explicit reporting requirements on human rights due diligence. The System of Warranties Guidelines therefore fall below international responsible business norms and leave mining communities at very real risk of exploitation and other serious harms.[125]

Standards for the Gold Sector

Responsible Gold Guidance by the London Bullion Market Association

Gold refineries have a unique opportunity to establish traceability and conduct human rights due diligence in their supply chain, as they receive gold from various sources but then usually mix it during the refining process. The London Bullion Market Association (LBMA)—the trade association of major gold refineries, bullion dealers, and banks—has a responsible sourcing standard, called the Responsible Gold Guidance, that all its members are required to comply with.[126] The LBMA’s standard follows the structure of the OECD Minerals Guidance. It covers a wide range of human rights, environment and anti-money laundering measures and makes explicitly clear that it applies to mined and recycled gold.[127]

However, the Responsible Gold Guidance has several gaps, including a failure to require full traceability. The OECD itself has found that the LBMA falls short in its implementation; for example, the LBMA has certified refiners even when their internal and external risk assessments lacked quality and rigor, and due diligence measures did not extend beyond its immediate (tier 1) suppliers.[128] Another concern is that the Responsible Gold Guidance does not have robust transparency requirements; for example, it does not require refiners to disclose who their suppliers are.[129] Perhaps in response to this critique, the LBMA has started to oblige refiners to share information on countries of origin, and has created an aggregated list of countries of origin that it plans to publish.[130]

Fairtrade and Fairmined Gold standards

The Fairtrade and the Fairmined standards for gold were launched by non-profit organizations to benefit disadvantaged artisanal and small-scale mine producers and workers in the Global South and increase their access to markets.[131] Buyers pay an extra sum (a premium) for Fairtrade and Fairmined gold to fund community programs to improve living conditions in mining communities. Both standards have detailed and rigorous requirements on a range of issues, including labor rights, the environment, and other human rights and are popular with many small jewelers. However, they lack transparency in some areas.

The Fairtrade Standard has 10 certified artisanal and small-scale mining sites in Peru; it also supports mines in Kenya, Uganda, and Tanzania that are working to achieve certification.[132] Nearly 100 supply chain actors, including licensed jewelers, are trading in and selling Fairtrade-certified gold.[133] Under the standard, all Fairtrade-certified gold must be traced back to the mine of origin. Mines of origin and traders are audited; licensed jewelers are only audited in exceptional circumstances.[134]

The Fairmined Standard has 10 certified mines in Colombia, Peru, and Mongolia, 19 authorized suppliers (such as refiners and traders), and over 200 licensed, consumer-facing companies (such as jewelers).[135] The standard requires traceability from the mine to the refinery. Consumer-facing jewelry companies can only sell gold with a Fairmined label if it is possible to trace the gold back to the certified mine of origin. Jewelry companies can also use Fairmined gold in their jewelry that has been mixed with other gold, but are not allowed to sell it with the label in that case.[136] The standard requires all mines to be audited on a regular basis. While most suppliers and licensees in the gold supply chain are audited as well, some—such as those mixing Fairmined gold with other gold—can opt out of an audit and submit a report to ARM instead.[137]

Production from certified Fairtrade and Fairmined mines is limited, in part because it requires significant resources to bring mines up to the standard. In 2019, for example, only 412 kilograms of Fairmined certified gold was sold to the market; this is about 0.0124 percent of global gold mine production that year.[138] As a consequence, most buyers of the gold are small jewelers; larger companies report that available quantities are not sufficient for their needs.

A number of initiatives seek to assist mines that are working towards compliance with human rights and environmental standards, including support programs from nongovernmental organizations (NGOs) and an open-source standard for responsible artisanal and small-scale mining, developed by ARM.[139] The list of mines using the open-source standard includes mines in Colombia, Honduras, Ghana, and Burkina Faso.[140]

Overall, both the Fairmined and the Fairtrade standard are positive initiatives seeking to ensure responsible gold supply chains spanning from small-scale mine to jewelers. Their strengths lie in the rigor of the requirements regarding human rights, the environment, and traceability. However, both standards have gaps in their certification processes and lack robust public reporting requirements. For example, Fairtrade and Fairmined do not make public audit reports and information on non-compliances and do not usually require jewelers to disclose the names of their first-tier suppliers.[141]

A Standard for Industrial Mining: The Initiative for Responsible Mining Assurance

The Initiative for Responsible Mining Assurance (IRMA) has developed a robust standard for responsible large-scale, industrial mining through a lengthy multi-stakeholder process that included companies, trade unions, and civil society groups. The board of IRMA is unique in that it has equal representation of mining companies, downstream companies, NGOs, affected communities, and trade unions—it is a multi-stakeholder initiative and not an industry initiative.[142]

The standard, which allows for certification of individual mines, was published in 2018.[143] In 2020, third-party audits were underway at three mines—in Mexico, Brazil, and Zimbabwe—and another seven mines were undergoing a self-assessment.[144]

The standard’s requirements on mining relate to a wide range of human rights and environment issues and are more detailed than those of the Responsible Jewellery Council, for example in relation to labor rights, Indigenous peoples’ rights, and the environment.[145] Audit results of companies are summarized by stating the percent of IRMA’s requirements that have been met. The results of the audit are to be made public in summary form, along with the percentage figure indicating to what degree companies are fulfilling requirements.[146] While this would not provide details on human rights risks or non-compliances found and addressed, IRMA’s reporting requirements may provide more transparency than most other standards.

The scope of the standard is limited to industrial mines, but other actors in the mineral supply chain—such as jewelry companies—can choose to source from IRMA-certified mines to reduce human rights risk; this would not, however, relieve them from their duty to conduct their own human rights assessments.

Need for Mandatory Supply Chain Standards

Human rights abuses continue to occur in the context of gold and diamond mining, despite the existence of numerous voluntary standards for responsible business conduct. While voluntary standards have in some cases increased awareness and led companies to improve their practices, they have not been able to bring about the industry-wide change that is needed. This is not only because the standards have some weaknesses, as described above, but also because they are voluntary in nature, companies that do not wish to join are not obliged to do so. This creates a disadvantage for the companies who source their minerals responsibly.

Ultimately, only mandatory human rights due diligence rules—national or regional laws—will create a level playing field and move the whole industry in the right direction. Some countries already have mandatory rules in place or are preparing for them.[147] For example, a European Union regulation on human rights due diligence for minerals will enter into force on January 1, 2021.[148] But the majority of countries still lack laws requiring all business actors to conduct robust human rights due diligence.

V. Company Rankings and Performance

Methodology

For this report, Human Rights Watch sent letters to the 15 companies profiled below requesting information about their policies and practices in relation to human rights due diligence and the sourcing of their gold and diamonds. These 15 companies were selected to include some of the industry’s largest and best-known jewelry and watch companies and to reflect different geographic markets. Of the 15 companies, 7 are based in Europe, 3 in the United States, and 5 in Asia. While these 15 companies are not representative of the entire industry, collectively, they generate more than $40 billion in annual revenue, about 15 percent of global jewelry sales.[149]

Thirteen of the companies were first assessed by Human Rights Watch in our initial report in 2018 and have now been evaluated for their progress between 2018 and 2020. Two companies, Chow Tai Fook and Mikimoto, were added to the assessment to increase the report’s geographic scope to include the Chinese and Japanese jewelry markets. They were assessed for their human rights due diligence efforts between 2018 and 2020.

Nine companies responded in writing to Human Rights Watch’s letters requesting information regarding their policies and practices on sourcing: Boodles, Bulgari, Cartier, Chopard, Chow Tai Fook, Pandora, Signet, Tanishq, and Tiffany & Co. The company responses varied widely, with some providing detailed information on their policies and practices in writing, and others providing only general information on their approach to sourcing. Six companies did not reply, despite repeated requests: Christ, Harry Winston, Kalyan, Mikimoto, Rolex, and TBZ. Of the companies that replied, Human Rights Watch also requested information regarding their response to the Covid-19 pandemic.

The information provided in this report is based on information provided to Human Rights Watch directly from the companies, as well as publicly available information from company websites, annual reports, disclosure statements, and other public sources.

Human Rights Watch assessed the companies based on the seven criteria below and evaluating what they were doing to achieve those objectives:

- Adoption and implementation of a robust supply chain policy—based on international human rights and humanitarian law, international labor standards, and the Organisation for Economic Co-operation and Development (OECD) Minerals Guidance—incorporated into all contracts with suppliers;

- Chain of custody over gold and diamonds, including efforts to trace these minerals to their mines of origin by requiring full supply chain documentation from suppliers;

- Assessment of all human rights risks throughout the supply chain, including evidence of human rights due diligence by upstream suppliers, such as on-the-ground mine assessments;

- Concrete steps to mitigate identified human rights risks, including by severing contracts with non-compliant suppliers;

- Third-party audits of the company’s and its suppliers’ human rights due diligence by auditors qualified to assess human rights issues;

- Annual public reporting on their human rights due diligence, including steps to manage and mitigate risks; and

- Publication of names of gold and diamond suppliers.

In addition, Human Rights Watch believes that jewelry companies should make the extra effort to support and source from responsible artisanal and small-scale mines that respect human rights standards. While labor abuses are widespread in the sector, artisanal mines provide income for millions of workers and thousands of mining communities. Instead of excluding artisanal suppliers from their supply chains, as many companies do, the jewelry industry should support efforts to formalize and professionalize artisanal mines and improve working conditions.

Based on a company’s performance with regards to these criteria, we have indicated whether the company is taking excellent, strong, moderate, weak, or very weak steps towards responsible sourcing. Companies that have shared little or no information publicly or with Human Rights Watch are in a separate category due to nondisclosure.

Summary of findings

Most of the jewelry and watch companies featured in this report have strengthened their efforts to source responsibly since Human Rights Watch first assessed them in 2018. Several strengthened their supplier codes of conduct, more rigorously screened their suppliers, or published previously confidential requirements of their suppliers. Some improved their traceability of gold and diamonds, publicly identified their suppliers, or opted to source only recycled gold. Several companies also increased transparency in reporting on their human rights due diligence.

However, all of the companies assessed can and should take additional steps to ensure that their jewelry is not tainted by human rights abuses. The majority of the companies assessed are still not able to trace their gold and diamonds to the mines of origin, and thus do not undertake human rights assessments or mitigation measures regarding conditions prevailing at these mines.

Although most of the companies provide information to the public regarding their sourcing practices and responded to Human Rights Watch’s requests for information, four of the fifteen companies—Kalyan, Mikimoto, Rolex, and TBZ—are highly untransparent: they disclose almost no information to the public about their approach to responsible sourcing and did not answer any of Human Rights Watch’s letters and emails for this report.

Below is a summary of findings regarding some of the key criteria for Human Rights Watch’s assessments:

Supplier Codes of Conduct: Eight of the fifteen companies assessed (or the relevant parent company) have a public supplier code of conduct, though the codes vary in how well they incorporate international standards. Since our 2018 assessment, two companies – Boodles and Christ – have made their codes public, and four companies – Boodles, Bulgari, Signet, and Tiffany & Co. – have revised or expanded their codes. Two companies assessed – Chopard and Harry Winston (including its parent company, the Swatch Group) – state that they have supplier codes of conduct, but do not make their codes public. In 2019, Tanishq informed Human Rights Watch that the company was in the process of formalizing a supplier policy, though they did not share it. Kalyan, Mikimoto, Rolex, and TBZ do not say publicly if they have supplier codes and did not respond to Human Rights Watch’s letters. Therefore, Human Rights Watch was unable to determine whether the remaining companies have codes for their suppliers.

Traceability: Very few companies can trace all their mined gold or diamonds back to the mines of origin, ensuring full chain of custody in order to reliably assess whether their materials are free from abuse. Of the 15 companies assessed in this report, 4 report that they can trace some of their gold back to the mines of origin: Boodles, Chopard, Harry Winston, and Tiffany & Co. In 2018, the Swatch group (parent company of Harry Winston) announced that it had full traceability for its gold. Tiffany & Co. also states that all of its newly mined gold can be traced to mines of origin. Since October 2019, Boodles says it sources all its gold from Yanfolila, a large-scale mine in Mali, and Chopard says it purchases some Fairtrade and Fairmined certified gold, which is traceable to mines of origin. Bulgari, Cartier, and Chopard say they are committed to sourcing gold certified against RJC’s Chain of Custody Standard, but as noted above, the standard does not require companies to trace their metal back to the mines of origin. While Bulgari and Cartier say they increasingly source gold certified under the Chain of Custody Standard from recycled sources, traceability remains a concern for any mined gold.

With regard to diamonds, few companies have traceability to the mine of origin since the major diamond mining companies do not provide this information. However, Boodles also has traceability for some of its diamonds. While Chow Tai Fook's T Mark “is committed to full disclosure of the life journey of diamonds,” [150] the company is able to trace a diamond to the mine of origin only in some cases. In others, it means only that Chow Tai Food has traced the diamond to a responsible supplier, but does not know the mine of origin.

Human rights risk assessments and mitigation: Most companies that Human Rights Watch reviewed do not conduct robust, comprehensive human rights assessments or mitigation measures—including on-site visits—regarding conditions prevailing at the mines of origin. One major reason for this is that companies only sometimes have traceability for their gold, and only rarely for their diamonds. Another reason is that some companies consider mere membership in an industry initiative—the RJC—a guarantee for responsible sourcing, even though this approach does not actually mean that they are conducting assessments.

Some companies have taken small steps to better assess and manage human rights risks in their supply chains. Boodles conducted a human rights risk assessment for the first time in early 2018 and has decided to exclude five countries from its sourcing, based on a set of criteria; while disengagement can be problematic, the measure shows that Boodles is developing systems to assess and address risks. Tanishq states that it has been working to improve conditions in its jewelry manufacturing suppliers with regards to safety and fair wages. Bulgari, Cartier, and Pandora increasingly use recycled gold as a way to avoid the human rights risks associated with newly mined gold.[151]

Third Party audits: Seven of the fifteen companies assessed regularly undergo third-party audits for responsible sourcing as part of their membership in the RJC. At least six of the fifteen companies assessed also require third-party audits for their suppliers, including Cartier, Chopard, Harry Winston, Pandora, Signet, and Tiffany & Co. Pandora reported that in 2019, 99 percent of its total direct sourcing value was subjected to third-party audits. Some jewelry companies, for example, Cartier, Signet, and the Swatch Group (parent company of Harry Winston) are increasingly requiring that their gold and diamond suppliers belong to the RJC. In 2019, Richemont (Cartier’s parent company) reported that 95 percent of its gold and diamonds were from RJC-certified sources. Signet reported that RJC members account for approximately 96 percent by value of all Signet purchases. By contrast, other companies—such as Bulgari and Tiffany & Co.—conduct their audits independently of the RJC.

Public Reporting: Eight of the fifteen companies assessed annually publish a report on their approach to sourcing. Most of these reports provide general information regarding their approach to sourcing and how they assess and manage human rights risks in their supply chains. However, very few companies include any information about the results of their audits, areas of noncompliance, or steps that they are taking to address problems. One company that continues to stand out in this regard is Pandora, the only company that includes an overview of noncompliance issues identified through its supplier audits in its annual sustainability report. Two companies that lack such an annual report—Boodles and Christ—do disclose information on their responsible sourcing approach on their websites. Kalyan, Mikimoto, Rolex, and TBZ publish almost no information about their approach to responsible sourcing.

Transparency regarding suppliers: Publishing information about a company’s suppliers provides consumers, investors, and affected workers and communities with more meaningful information about the source of jewelry and watches. It also sends a message that companies are willing to be accountable when human rights abuses are found in their supply chain. In 2018, we found that several companies—including Cartier, Chopard, Signet, and Tiffany & Co.—published the names of a few suppliers. In 2020, two companies – Pandora and Tiffany & Co.– published the names of their suppliers for both gold and diamonds. Pandora had previously not done so and Tiffany & Co. had only published some of its suppliers. Regrettably, two companies – Signet and Cartier – no longer published their gold or diamond suppliers in 2020, despite having done so previously.

Sourcing and support for the artisanal sector: Artisanal mines provide income for millions of workers and thousands of mining communities. Jewelry companies can play an important role by supporting efforts to formalize and professionalize artisanal mines, improve working conditions, and by sourcing from these mines. In 2018, four companies – Cartier, Chopard, Signet, and Tiffany & Co.– provided support for initiatives to improve working conditions at artisanal and small-scale gold mines, but only two —Chopard and Cartier — purchased gold from such mines. By 2020, two additional companies – Signet and Tiffany & Co.– had also purchased gold from artisanal and small-scale mining and made it available in their jewelry.

How Diamond Mining Companies’ Lack of Traceability Impacts the Jewelry Supply ChainThe diamond industry is dominated by a few large diamond mining companies. The two largest diamond miners are De Beers and Alrosa, which control about half of the world’s rough diamond production, though their current production is down due to the Covid-19 pandemic. Both De Beers and Alrosa have significant influence over sourcing practices in the jewelry sector. These companies have made it effectively impossible for jewelry companies that source from them to have full traceability. De BeersThe London-based De Beers Group is one of the world’s largest diamond mining companies with an annual revenue of about $4.6 billion.[152] Its mines are located in Botswana, Canada, Namibia, and South Africa.[153] De Beers has several internal policies and a set of detailed requirements for its mines, other operations, and its contractors called the "Best Practice Principles.”[154] Businesses to whom De Beers sells diamonds are both accredited buyers and so-called “sightholders,” including trading companies and manufacturers.[155] The Best Practice Principles cover a wide range of issues, including business ethics, human rights, environment, and mining. De Beers aggregates diamonds from multiple mines before selling them to other businesses, and therefore does not provide buyers with information regarding the specific mines of origin. De Beers has been criticized for this lack of traceability.[156] In April 2019, likely in response to some of the criticism, De Beers publicly stated that its diamonds originate from the Diamond Trading Company (a subsidiary), and the Diamond Trading Company then launched a new website with information on human rights issues checked at each of its eight mines of origin.[157] While the website includes a summary of audits under the Best Practice Principles, it lacks detail and does not allow for traceability of diamonds from industrial mines. AlrosaRussia-based Alrosa is the world’s largest diamond mining company by volume, accounting for 26 percent of global diamond production (by carats). In 2019, Alrosa produced 35.5 million carats of rough diamonds and its revenue from sales was about US$2.7billion.[158] Alrosa Group operates eight open-pit and three underground diamond mines in Russia’s Yakutia and Arkhangelsk regions.[159] In Zimbabwe, the company has set up a joint venture with the state-owned Zimbabwe Consolidated Diamond Company (ZCDC) to develop geological exploration and mineral production.[160] Alrosa also owns a stake in Catoca Mining Company, Ltd., which had planned to mine diamonds in 2020 but had to suspend operations due to Covid-19.[161] In 2018, Alrosa updated its Policy on Sustainable Development and Corporate Social Responsibility and its Alrosa Alliance Guidelines on Responsible Business Practices.[162] In March 2020, the company adopted new regulations on responsible diamond supply chain management, aligning its due diligence to the OECD guidance. Alrosa states that it conducts due diligence of its diamond supply chain management system and of its suppliers and joint ventures on an annual basis.[163] Alrosa publishes an annual Social and Environmental Report, which describes its risk assessment and risk management related to environmental impacts and labor rights, but provides little information regarding the results of audits or instances of non-compliance with human rights or other standards.[164] In 2020, Alrosa adopted a new internal diamond tracking and traceability system to provide information on the region of origin of its rough and polished diamonds from Russia.[165] The company states that Alrosa diamonds produced in different regions are not mixed in the process of sorting, valuation, cutting and polishing, and trading.[166] However, it operates several mines in each region and does not provide information on the individual mine of origin for its diamonds, but only on the region and in some cases subregion. |

Jewelry company profiles

Boodles (UK)

Boodles is a family-owned luxury jeweler from the United Kingdom with over $100 million revenue in 2019.[167] The company has improved its responsible sourcing practices since 2018 and is now in the fair category of Human Rights Watch’s ranking.