<<previous | index | next>>

VIII. Trade in Tainted Gold

International mining companies restarted mining operations in northeastern DRC only in 2003.332 But while modern mining methods may not have been available, gold has continued to be mined by local artisanal miners throughout the duration of the conflict, sometimes in large quantities. The gold mining and trading activities are controlled by the armed groups and their business allies. They funnel this gold out of the Congo to Uganda via a network of traders who operate outside of legal channels. The trade in gold allows armed groups to transform the gold into money to sustain their operations. Without the proceeds from the gold trade, armed groups in Ituri would face serious difficulties in carrying out their military operations; activities which frequently include widespread human rights abuses.

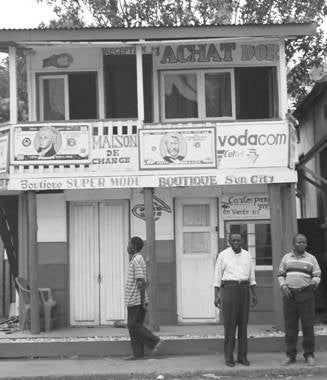

A gold trading

house in Beni where gold from Mongbwalu is bought and sold. © 2004 Human Rights

Watch

From 1996 through the present, the Congolese transitional government has had little, if any, control over some eastern parts of the country where the richest sources of gold are found. Hidden by the “fog of war” in this region, unlicensed parties grew rich by trading gold while armed groups that protected and were supported by them continued conflict and human rights abuses against civilians. The U.N. panel of experts on illegal exploitation in the Congo reported that the complexity of relationships among those who support, protect, and benefit from such trade and their dependency on it, makes ending these activities very difficult.333 A conclusion confirmed by another U.N. group of experts investigation into breaches to the arms embargo who reported in January 2005 that the business networks, including gold traders, which helped to sustain arms trafficking remained active in eastern DRC.334

Human Rights Watch researchers traced the trade in gold between the local buyers in Mongbwalu and Durba to a second group of purchasers who in turn sold the gold to larger-scale trading houses in bigger towns. These trading houses and their owners fraudulently exported the gold to legally registered traders in Uganda. Ugandan traders sold the gold to companies abroad, primarily in Switzerland and other parts of Europe, thus completing its integration from the conflict zone into the global economy. Those who participate in buying tainted gold from northeastern DRC may indirectly be providing a revenue stream for armed groups who carry out massive human rights abuses.

The New DRC Mining Code

In July 2002 the Congolese government, assisted by the World Bank, established a new Mining Code to regulate the extraction and trade in certain listed minerals, including gold.335 Many investors applauded the code, expecting it to bring order to the extractive industries. Some regulations, like those on artisanal exploitation of minerals, were similar to previous legislation. Artisanal miners, licensed by the state, were to be permitted to extract minerals throughout the country, except in areas restricted by concessions granted by the government. To show they were authorized to extract gold, diamonds, or other minerals, artisanal miners had to obtain cards valid for the area concerned.336 Artisanal miners were permitted to sell gold only to state-authorized traders, exchange markets, or trading houses337 Traders, who generally brought at the mining site and sold to trading houses in larger towns, could sell only in the Congo and were not authorized to export gold.338 The new mining code permitted the export of gold only by trading houses so authorized by the Minister of Mines in Kinshasa, who had authority to limit the number of export licenses granted.339

In an interview with a Human Rights Watch researcher, officials from the Ministry of Mines deplored the lack of funding from the government and international donors to implement the new regulations, a process they expect to take years.340 Ministry officials in Kinshasa know little about mining contracts or how the code is being applied in former rebel-held territories and claim there is no funding for them to go to the east to enforce regulations. They further claim the Minister of Mines, an appointment from civil society, was often left out of decisions on mining made by the President or the Vice-Presidents. He was removed from his position by President Kabila for mismanagement and corruption in December 2004, charges the minister denied.341 One senior official at the Ministry of Mines said,

The multinational companies don’t care whom they talk to. They just want to go and see the boss … the Vice Presidents or the President. The Ministry of Mines is simply not involved. The politicians are just pursuing their own interests. We are powerless to control all of this. We have no means to do so. It’s all the same, nothing has changed since the U.N. Panel report came out. The rebels and other government people who have arrived all have different agendas and they are not united. The big problem is money. If you want to succeed in politics you need money. So they are not in a rush to review the contracts signed previously.342

Organization of the Gold Trade through Butembo and Ariwara

With government officials lacking the means to enforce regulations, a few important traders based in Butembo, North Kivu Province, and Ariwara, Oriental Province, have monopolized the gold trade from Mongbwalu and Durba. Several of them are accused of providing transport services, including the transport of arms, to leaders of armed groups in return for their help in controlling the gold trade and assuring the smooth export of their gold (see below). According to the U.N. group of experts investigating violations of the arms embargo in eastern DRC, armed groups and their business partners generate the revenue needed to buy weapons and carry out military activities by controlling the trade in gold and other commodities and manning strategic border posts.343

In Butembo, one of the largest trading houses (comptoirs) is owned by Dr. Kisoni Kambale and, in Ariwara, one of the major houses is owned by Mr. Omar Oria. Other traders estimated that these two control over fifty percent of the gold trade from northeastern Congo.344

The artisanal miners in northeastern Congo estimate they earn about $10 a day selling their gold for cash to local traders. In Mongbwalu for example, miners sell to one of some forty traders who then sell it to one of a second group of ten purchasers who in turn sell to trading houses in Butembo. In some cases the trading houses provide cash advances to the local traders to facilitate their purchases. Owners of the major trading houses generally set the local price to be paid for the gold and control the means of transportation to and from the mining areas.345

Dr Kisoni in Butembo

Dr Kisoni Kambale, owner of the Congocom trading house, is the most important gold trader in Butembo. Congocom handles so much gold that it operates its own foundry to melt the ore into ingots before exporting it, as Congocom customers have seen.346 According to one such customer, Kisoni bought the machinery with help from Ugandan associates.347

Traders in Mongbwalu told a Human Rights Watch researcher that they bought gold for Dr. Kisoni,348 an assertion confirmed by the FNI Commissioner of Mines. He said,

Dr Kisoni gives money to people and they buy the gold in Mongbwalu. Nearly all of the gold purchasers work for Dr Kisoni. There are about ten of them and they control the gold buying. Dr Kisoni owns Butembo Airlines. The gold goes straight from the plane to his office in Butembo.349

The aviation

company Butembo Airlines run by Dr Kisoni Kambale unloading its cargo after a

flight to Mongbwalu. The plane is frequently used to transport gold. © 2004 Human Rights

Watch

Local traders and other informed sources estimated that between twenty and sixty kilograms of gold left the Mongbwalu area each month, most of it destined for Butembo. Based on the price of gold at the time of writing, this would have a value between $240,000 and $720,000. Human Rights Watch could not confirm such estimates, which may be below the actual amount traded (see below).350

Dr. Kisoni and his company lease a small Antonov plane that flies under the name of Butembo Airlines (BAL) and that transports merchandise, including gold. Butembo Airlines makes regular trips to Mongbwalu, sometimes flying on a daily basis. At the time of writing, it offered the only transport by air to Mongbwalu, which is hard to reach by road. Some traders who used BAL to transport their gold said the plane also carried weapons for the FNI.351 A British Parliamentary report in October 2004 quoted Dr. Kisoni as saying that he regularly supplied food to the armed groups in Mongbwalu and that he did not check the contents of the cargo on his plane.352 The U.N. group of experts investigating violations to the arms embargo reported that BAL had gained exclusive landing rights into Mongbwalu on the condition it facilitated outward shipment of gold for the FNI. They went on to express concern that the contents of the plane were never checked.353 Mavivi Air, another transport company that once flew between Mongbwalu and Butembo had its craft impounded at Beni airport for carrying weapons in July 2003. A MONUC investigation into the affair reported that Mavivi and other such airlines were playing an important role in the trafficking of arms in the region.354 Mavivi Air has since gone out of business.

Numerous witnesses in Mongbwalu, Butembo, and Kinshasa described the connections between gold traders and the RCD-ML armed political movement. Although at the time of research in early 2004, the RCD-ML was nominally a partner in the transitional government, it continued to act as an autonomous agent profiting from the gold trade in the region it controlled. One important member of RCD-ML told a Human Rights Watch researcher that Dr Kisoni was essential in financing his movement. He said, “Kisoni was the cashier of the rebellion.”355 Another witness explained the reciprocal arrangement between RCD-ML authorities and the traders. He said,

When the [RCD-ML] movement needs money they ask the traders. They in turn get exemptions from taxes [collected by RCD-ML agents] at the border for their trade and this is how the deals are done. The movement then uses this money to buy weapons.356

An official from the Ministry of Mines agreed that there was an important tie between Kisoni’s company and the RCD-ML. He said, “Congocom has the monopoly on the gold trade and they are sustained by the [RCD-ML] rebellion.”357

A gold ingot from ore mined in Ituri made at the foundry of Dr. Kisoni

Kambale in Butembo. The gold is smuggled to Uganda, from where it is exported

to global gold markets in Europe. © 2004 Human Rights Watch

Traders who export gold illegally, without paying taxes or duties to the state, violate articles 120 and 126 of the Mining Code and are liable to fines of between $10,000 and $30,000 and to being prohibited from engaging in the gold trade for five years. Any person who threatens mining officials carrying out their lawful duties is subject to six months imprisonment.358 But mining officials in North Kivu told Human Rights Watch researchers that they lacked the resources to enforce the provisions of the code and for this reason had not executed ministry instructions to put an official in each trading house in Butembo. They said they also feared retribution from powerful commercial and political interests should they attempt to enforce the law.359

One ministry of mines official told Human Rights Watch researchers that no trading house in Butembo had a license from the Congolese government to export gold, including Congocom. He said that Congocom had never declared its exports to state agents even though it was—as he knew--the largest gold exporter in the area.360 He said that because much of the gold was traded in violation of the mining code, it was impossible to know the amount of gold exported from the area. “We just watch our country’s resources drain away with no benefit to the Congolese people” he said.361

Omar Oria in Ariwara

Human Rights Watch researchers visited the thriving town of Ariwara in March 2004 and found more than forty gold trading houses in the central market area. Gold traders and other local sources estimated that between 80 and 160 kilograms of gold were traded each month through Ariwara, which is located near the Ugandan border. Such estimates cannot be verified but seem to fit generally with statistics for the export of gold from Uganda (see below).362 At the time of writing the trade was valued at between $1 to $2 million per month.363

Ariwara lies in the zone controlled by Commander Jérôme’s FAPC forces, whose abuses have been extensively discussed previously. Gold traders must purchase permits (carte de negociant d’or) from the FAPC to trade gold, a requirement modeled on state practice.364 The FAPC keeps all registration fees for its own use. The U.N. group of experts investigating violations of the arms embargo concluded that Commander Jérôme organized strict control over key exports such as gold together with businessmen willing to do his bidding.365

Omar Oria,a Ugandan citizen, is one of the main gold traders in Ariwara, according to other gold traders and residents, and as previously mentioned, works closely with Commander Jérôme.366 One trader told Human Rights Watch researchers that Mr. Oria advanced each of his local purchasers between $5,000 and $10,000 a week to buy gold on his behalf.367 Much of this gold was bought in Durba and the immediate surrounding area. Many local traders in Durba confirmed that they worked for Mr. Oria.368 In an interview with a Human Rights Watch researcher, Mr. Oria said that he traded gold, explaining that he sold gold in Uganda for Congolese clients and then depositing the proceeds into foreign bank accounts on their behalf.369

Mr. Oria’s business is not authorized by the state as a trading house and so cannot legally export gold from the Congo nor is it licensed to operate in the foreign exchange market.370 Mr. Oria’s relationship with Commander Jérôme facilitates his illegal trade. Mr. Oria is protected by some of Commander Jérôme’s combatants, several of whom have beaten, tortured, and even killed gold traders accused by Mr. Oria of having cheated him (see above). Witnesses claimed Mr. Oria helped finance the FAPC movement and regularly provided food and perhaps other supplies for FAPC combatants.371 The U.N. group of experts investigating violations of the arms embargo concluded that proceeds from customs and immigration, including those from the gold trade, were channeled into the coffers of the FAPC and used to pay for its military infrastructure. In one case, the group of experts obtained forty handwritten receipts signed by FAPC commanders withdrawing cash from border proceeds for “military emergencies” and “combat rations.”372 Several witnesses said that Mr. Oria and Commander Jérôme were frequently seen together and that Mr. Oria on occasion stayed in Angarakali, the FAPC military camp in Ariwara.373

Gold traders

conducting business. © 2004 Marcus Bleasdale

Congolese Gold Exported to Uganda

The gold traded from northeast Congo goes principally to one destination – Uganda. Both Dr Kisoni and Mr. Oria sell their ‘tainted gold’ to Ugandan traders based in Kampala, many of whom in turn sell gold to companies in Switzerland and other destinations.374 Most of this gold is exported illegally from Congo: traders have no export permits or exchange documents, are not authorized trading houses, do not keep accounts at the Central Bank of Congo and do not pay relevant taxes and duties as required under Congolese law.375 The Congolese population gain almost no benefit from this trade; instead they suffer grave human rights abuses by groups seeking to control the trade and the gold mines.

The gold is “legalized” in Uganda. Traders in Kampala do not require their Congolese clients to present documents authorizing the export of gold, operating on an “ask no questions” basis. They treat the gold as if it were a transit good, filling out customs forms and other documents required to make its export legal from Uganda and acceptable in the unregulated global market.376

In the 1990s most unlicensed exports of gold from Congo went to Burundi, but civil war in Burundi and a regional trade embargo declared in 1997 made Burundi less attractive as a transit point. After a brief shift through Kenya, the trade moved to Kampala where the climate was more favorable. In 1993 the Ugandan Central Bank eased restrictions on gold sales and decided not to tax gold exports.377 This change followed five years later by the establishment of Ugandan army control over rich gold mining areas of northeastern Congo resulted in a dramatic increase in gold exports from Uganda (see chart below).

Gold Export Figures from Uganda

According to official statistics, Uganda exported nearly $60 million in gold in 2002, a peak year, and about $46 million in 2003. But in 2003 specialists in the trade valued it still at $60 million.378 According to the Central Bank of Uganda, data from these industry experts may be more accurate than that compiled from government customs data.379 Whether using industry or official statistics the increase in gold exports has been remarkable. Gold is currently the third top Ugandan export, after coffee and fish.380 In 2001 gold accounted for 84 percent of the total value of all minerals exported from Uganda; in 2002 it was 99 percent.381

Most of the gold exported from Uganda comes from Congo. Domestic production in Uganda is negligible, despite encouragement from the World Bank and new mining regulations introduced in 2001. Statistics from the Ministry of Energy and Mineral Development and official export figures shows that Ugandan gold production accounts for less than 1 percent of the official gold exports.382 In the annual report of the Ministry of Energy and Mineral Development, discrepancies between gold production and gold exports are striking. In 2002, for example, domestic gold production was valued at $24,817 while gold exports for the same year were listed as just under $60 million.383 When Human Rights Watch researchers asked Ministry representatives about this discrepancy, they refused to comment.384

Import statistics fail to show the real scale of the gold trade. Officially, gold brought into Uganda should be declared upon entry as an import if expected to stay in the country, or as a transit good if intended for another final destination. But official Ugandan import statistics show a tiny amount of gold imported to the country and show no statistics for transit goods. The unofficial trade in gold is likely facilitated by the lax enforcement of regulations at the Uganda-Congo border posts. According to a study conducted in 2004 by the Ugandan Bureau of Statistics (UBOS), over 50 percent of all imports and exports went unrecorded at six border posts.385 In cases where people wanted to hide precious minerals, the study estimated the entry of such goods went completely unrecorded. The U.N. group of experts monitoring the arms embargo to eastern DRC observed that at the northern border post of Vurra, between Aru (DRC) and Arua (Uganda), there was limited or no customs and immigration inspection, especially in the case of FAPC combatants who were allowed to cross freely.386

Since Ugandan gold production figures are less than 1 percent of official exports, most gold being exported must have entered Uganda from elsewhere. Official statistics fail to record the entry of significant amounts of gold hence most of this trade must be illegal and unrecorded. In 2004 the discrepancy between gold produced in the country and that exported was just over $45 million per year, as shown by the official figures below.

Table 1:

Official Ugandan Gold Import, Export and Production, Figures in US$

|

Year |

1998 |

1999 |

2000 |

2001 |

2002 |

2003 |

2004 |

|

Gold Exports |

18,600,000 |

38,360,000 |

55,730,000 |

50,350,000 |

59,900,000 |

45,760,000 |

45,590,000 |

|

Gold Imports |

0 |

2,000 |

3,076,000 |

890,000 |

0 |

2,000 |

n/a |

|

Local Gold Production |

n/a |

40,307 |

477,000 |

1,412 |

24,817 |

23,000 |

21,000 |

|

0 |

60460000 |

758430000 |

2460000 |

44436000 |

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

Discrepancy |

18,600,000 |

38,317,693 |

52,177,000 |

49,458,588 |

59,875,183 |

45,735,000 |

45,569,000 |

Note:

Statistics for 2004 are estimates

Source:

Ugandan Bureau of Statistics, Ministry of Energy and Mineral Development and

Central Bank of Uganda.

Gold Traders in Kampala

Gold industry experts in Kampala acknowledged and readily explained the discrepancy between domestic production of gold and amount of its export, as shown by official statistics. In interviews with Human Rights Watch researchers, gold traders confirmed that most of the gold they exported came from Congo. They estimated the trade to be worth about $60 million per year.387 There are three main gold export businesses in Kampala. The largest two, Uganda Commercial Impex Ltd and Machanga Ltd, control an estimated 70 percent of the export trade from Uganda. Since profit margins on each trade are relatively small, these traders make profits by trading in high volume and by offering good quality gold, for which they need a reliable source of supply.

Uganda Commercial Impex Ltd. is the largest gold exporter in Uganda. In an interview with Human Rights Watch researchers, its representatives said that nearly 90 percent of their gold came from Ituri and they confirmed that Dr Kisoni Kambale from Butembo was “one of their customers.”388 Company representatives explained they paid their customers cash for the gold or transferred funds into the customer’s bank accounts held either locally or abroad. Like Dr. Kisoni, they had their own refinery on the premises, to process any gold that arrived as ore before exporting it to Switzerland and South Africa. Representatives of the company stated they declared the gold upon export, ensuring that a customs form and airway bill accompanied each shipment.389

Representatives of Machanga Ltd, the second largest gold exporter, also told Human Rights Watch researchers that the gold they traded came from Congo and they confirmed that one of their customers was Mr. Omar Oria.390 They further explained they advanced cash for the purchase of gold, sometimes as much as 30 percent of the anticipated purchase price, a system used also by Mr. Oria in Ariwara. Machanga representatives stated they exported all their gold to Metalor Technologies SA, a gold refining company in Switzerland.391 Other traders stated they also sold gold to Switzerland as well as to other locations such as South Africa and Dubai.

Trading companies in Kampala do not operate illegally but rather benefit from the loose regulation of the gold trade. Not required to request import documentation or to ask the origin of the gold, they buy smuggled Congolese gold as if it had entered Uganda legally and export it as a legal commodity. An essential bridge to the global economy, they benefit from the risks taken by Congolese dealers like Dr. Kisoni and Mr. Oria and from their relationships with local armed groups.

They may however be breaching a U.N. arms embargo. The U.N. group of experts concluded that firms and individuals entering into financial relationships with Ituri armed groups may be in violation of the U.N. arms embargo on eastern DRC.392

Encouragement of the Gold Trade by the Ugandan Government

President Museveni has sought to expand the weak economic base in Uganda by increasing exports. Coffee, the most important export commodity in the past, provided some 40 percent of overall export earnings. But a drop in world price for coffee hit the Ugandan economy hard, as did increased international oil prices. Continuing poor revenue return and corruption have further weakened the economy. The impact of joining the East African Community customs union, expected to be beneficial in the long run, may be negative at first.393 Increase in the export of gold, one of the fastest growing non-traditional export sectors, offers some hope in this otherwise bleak picture. The government believes that trade in minerals has the potential to rival coffee as a source of foreign exchange for Uganda. In January 2004 the Ugandan government signed a $25 million loan agreement with the World Bank to finance exploration of the country’s mineral deposits.394 Domestic mineral production may at some point substitute for some of the gold imported from Congo, but such a development is a long time in the future.

Since 1999 the Ugandan government has rewarded Ugandan gold exporters for their efforts to promote the trade. In 2002 Uganda Commercial Impex Ltd. received the President’s Export Award for best performance in the gold trade sector and Machanga Ltd. placed second in the competition. Hon. Omwony Ojok, the Minister of State in the office of the President responsible for Economic Monitoring, represented the President at the gala awards ceremony, attended also by five other government ministers.395 The companies were honored for encouraging the export trade and for fulfilling social responsibilities as part of their business. It is not clear how carefully the selection committee examined their business relationships with Congolese traders, themselves linked to armed groups responsible for human rights abuses in Congo.

The Ugandan government has proposed tighter controls on gold imports, perhaps in an effort to increase its own revenues. Among the regulations being discussed is one that requires permits for all precious metals imported into Uganda and that imposes an import tax of .5 percent of the purchase price.396 These regulations have not yet been accepted as law. Stricter regulation of the gold trade in Uganda and other transit countries would assist in stamping out the illegal smuggling and in cutting the link between the gold traders and armed groups who commit human rights abuses. The proposals by the Ugandan government would increase Ugandan revenue and may help somewhat in recording the gold trade coming from the DRC but without requiring further checks such as exit certificates, it is unlikely to curb the trade by illegal smugglers.

Buyers of Tainted Gold

According to the U.N. panel of experts on the illegal exploitation of Congolese resources, companies who buy gold from Uganda may also be contributing indirectly to human rights abuses in the Congo. After mapping the interconnections between Congolese parties to the conflict, foreign governments, and companies, the panel maintained that some business activities, directly or indirectly, deliberately or through negligence, contributed to the prolongation of the conflict and related human rights abuses.397 Gold industry experts and companies who trade in gold must, or should be, aware that most of the gold traded from Uganda comes from a conflict zone in the Congo and that it was likely to have been exported illegally.

Switzerland: Unaccounted Gold?

According to industry experts in Uganda, over 70 percent of the gold exported from Uganda is destined for Switzerland. Switzerland is one of Uganda’s main trading partners. According to Ugandan trade statistics, exports to Switzerland jumped from $29 million in the year 1999 to $99 million in the year 2000, a record high for trade from Uganda to Switzerland. Although trade decreased to $70.6 million and then to $69 million in the following two years, it remained considerably higher than in the years before war began in Congo. According to Ugandan trade figures in 2002, Switzerland was Uganda largest single trading partner receiving over $69 million worth of goods, with Kenya its second largest trading partner receiving goods valued at $61.5 million.398

It is likely that a large percentage of the trade from Uganda to Switzerland is gold. According to official Swiss information, imports from Uganda, excluding gold, amounted to just over $11 million in both 2002 and 2003; most of this trade was in coffee.399 Swiss imports of gold are classified as “sensitive data.” The Swiss government provides only the total amount of gold it imports and exports each year, without producing a breakdown of the country of origin. But Swiss government officials estimated imports from Uganda, to have been approximately $13 million in 2003 (see table below).400

Table 2:

Swiss Import and Ugandan Export Statistics: Some Glaring Discrepancies

|

Year |

2001 |

2002 |

2003 |

|

Swiss imports from Uganda excluding gold |

$6,965,000 |

$11,405,898 |

$11,637,025 |

|

Swiss gold imports from Uganda (unofficial number) |

$14,315,187 |

$1,684,140 |

$12,631,047 |

|

TOTAL Swiss imports from Uganda according to Swiss import statistics (gold plus other imports) |

$21,280,187 |

$13,090,037 |

$24,268,072 |

|

|

|

|

|

|

TOTAL exports from Uganda to Switzerland according to Ugandan export statistics |

$99,104,000 |

$70,674,000 |

$69,011,000 |

|

|

|

|

|

|

Discrepancy |

$77,823,813 |

$57,583,963 |

$44,742,928 |

Source: Administration Federale des Douanes (AFD), Commerce Exterieur de la Suisse; and Ugandan Bureau of Statistics. Unofficial figures come from Swiss federal government sources.

A comparison of Ugandan export and Swiss import statistics in 2001, 2002 and 2003 shows some glaring discrepancies. In 2003 goods from Uganda worth over $44 million were not registered at the point of entry into Switzerland and were unaccounted for; in 2001 the figure was $77 million. When questioned about the discrepancies, Swiss customs agents told Human Rights Watch researchers that it was possible the goods had entered Swiss free port zones; areas normally based around airports which effectively operate outside of Swiss government control.401 Goods entering such zones are not registered or taxed, are not reflected in Swiss import statistics and are sent to other locations without export duties. As the most valuable commodity imported from Uganda, gold could form a substantial part of the Ugandan goods entering the free port zones. According to one Swiss trade official, Swiss banks are possible candidates who may be buying gold through free port zones.402 While free port zones are part of Swiss territory, they operate outside of Swiss customs control. A Swiss customs official told Human Rights Watch researchers, “The control of free ports is beyond us.”403

Free ports are not transparent and may hide illegal activities. Recognizing these risks, the Swiss government in December 2003 submitted a new Customs Act to parliament to tighten control at free ports. At the time of writing the new act was still under discussion with no consensus on which goods should be more closely monitored by customs agents. But a Swiss customs official told Human Rights Watch researchers that gold was unlikely to be subject to stricter controls under the new law.404 Were Switzerland to impose stricter controls on gold transiting through free ports, it could facilitate efforts to stop the trade in tainted gold from Congo to other parts of the world.

Metalor Technologies SA

While a large part of the gold traded from northeastern Congo via Uganda is difficult to trace, it is clear that an estimated $13 million worth of gold entered Swiss territory from Uganda in 2003 and was officially registered as an import.405 According to research done by Human Rights Watch, some of this gold imported into Switzerland is bought by Metalor Technologies SA based in Neuchâtel, Switzerland, one of the oldest manufacturers of products for the international gold market. Metalor ranks among the leading refiners in the world of gold and other precious metals. In 2003 the company’s net sales were $225 million.406

A representative of the Ugandan-based gold exporting agency Machanga Ltd., told Human Rights Watch researchers that his company exported all its gold to Metalor.407 Representatives of Machanga also confirmed to Human Rights Watch representatives that they bought gold from Mr. Omar Oria,408 a close business associate of Commander Jérôme, based in northeastern Congo. Mr. Oria directly participated in human rights abuses including cases of torture and arbitrary detention carried out by Commander Jérôme and his FAPC armed group as documented by Human Rights Watch (see above). A United Nations group of experts monitoring the arms embargo on eastern DRC also reported that Metalor was a buyer of gold from Machanga.409 Thus Metalor through its purchases of gold from Machanga may be indirectly involved in a trade that supports an armed group responsible for serious human rights abuses.

In a December 17, 2004 letter responding to an inquiry from Human Rights Watch, Metalor declined to say whether Machanga was a supplier of gold to the company without first seeking Machanga’s approval, stating that “disclosing information on our suppliers and certain transactions would be contrary to confidentiality and secrecy obligations imposed on us.”410 It is not clear from this or subsequent correspondence if the company attempted to contact Machanga to obtain such permission.411 In a meeting with Human Rights Watch on April 21, 2005, a representative from Metalor confirmed the company bought gold from suppliers in Uganda, though the company insisted on retaining confidentiality as to the identity of those suppliers.412

In its meeting with Human Rights Watch and in its letters of December 17, 2004 and April 14, 2005, Metalor stated it did not accept goods originating from criminal activity, from criminal or terrorist groups or goods used to finance criminal activities. It claimed to comply with all measures required by a Swiss federal law on money-laundering and the Swiss precious metals control act, including requiring assurances from its suppliers that they owned the goods, that such goods had been acquired legally and that all necessary measures had been taken to prohibit the trade of goods from unlawful origin.413 In its meeting with Human Rights Watch, the company representative explained that Metalor’s client managers regularly visited their suppliers, including any in Uganda, to conduct due diligence checks, though she was unclear as to when the last visit had taken place to the company’s suppliers in Uganda.414

In an email communication on February 1, 2005, Metalor claimed, “Due diligence [was] carried out by all reasonable and lawful available means (such as governmental bodies, official institutions, diplomatic representations, financial information providers, registries of commerce, etc.).”415 In its April 2005 meeting with Human Rights Watch, a Metalor representative stated that as part of these checks the company had sought information from authorities such as the Swiss State Secretariat for Economic Affairs (SECO).416 When questioned about the results of these checks, the Metalor representative explained that such contacts were not always formal or documented but that the company had received no “negative responses” in relation to the trade of gold from Uganda.417

Despite these assurances, questions remain about the thoroughness of Metalor’s due diligence checks. Since Uganda’s domestic gold production is negligible and since Uganda does not import gold from other countries, gold exported from Uganda to Metalor is almost certainly mined in northeastern Congo. When presented with publicly available gold export and mining production statistics from official Ugandan sources, the Metalor representative expressed surprise at the obvious discrepancy.418 The representative stated Metalor had never seen such statistics and was unaware of any discrepancy, even though the company admitted to having met on more than one occasion with the Ugandan mining commissioner,419 an individual likely to have been well aware that the vast majority of gold exported from Uganda originated from northeastern Congo as reflected by the statistics published in department’s annual report.420 Metalor stated the information presented by Human Rights Watch during the meeting of April 2005 would be fed into its due diligence process.

The Metalor representative stated to Human Rights Watch that the company “believed the gold [it bought] was of legal origin.”421 Yet the gold traders in Kampala from whom Metalor acquired its gold were clear when interviewed by Human Rights Watch researchers that the gold they bought originated from Congo and that they did not request documentation from their Congolese suppliers such as import and export certificates.422 Between 2001 and 2004 numerous reports were published, including ones in Swiss newspapers, about the trade in natural resources from the Congo describing the horrific human rights abuses that the revenue helped to finance.423 In its April 2005 meeting with Human Rights Watch, the representative from Metalor stated the company was unaware of such information and had not heard about a series of public U.N. panel of experts reports published between April 2001 and October 2003 describing in detail how the exploitation of Congo’s resources had funded armed groups in eastern Congo and how the trade in gold from Congo was being funneled through Uganda.424 In its meeting with Human Rights Watch, the Metalor representative explained that on occasion the company carried out additional checks on its suppliers in circumstances when it noticed ‘red flags’ – information from public or private sources raising questions about a specific country of origin or the ethics of a supplier.425 Until recently when Metalor was mentioned in a report by a U.N. group of experts monitoring the arms embargo in eastern DRC, it appears no red flags were raised in relation to the gold Metalor bought from its suppliers in Uganda. Metalor representatives did inform Human Rights Watch that they were carrying out further checks with their suppliers in light of the U.N. report.426

Metalor knew, or should have known, that gold bought from its suppliers in Uganda came from a conflict zone in northeastern DRC where human rights were abused on a systematic basis. Under international business norms such as the OECD Guidelines for Multinational Enterprises, to which Switzerland is a party, companies are obliged to encourage suppliers to apply principles of corporate conduct compatible with the OECD Guidelines, including provisions on human rights.427 The U.N. Norms on the Responsibilities of Transnational Corporations and Other Business Enterprises with Regard to Human Rights, state that companies “within their respective spheres of activity and influence,”428 including through their suppliers, have an obligation to promote and ensure respect for human rights. Metalor should have considered whether its own role in buying gold resources from its suppliers in Uganda was compatible with ensuring respect for human rights and it should have actively checked its supply chain to verify that acceptable ethical standards were maintained. In its own annual report, the company reaffirmed its commitment to do so.429

Armed groups in Ituri would face serious difficulties in supporting their military operations if they were unable to turn gold into funds to buy arms and other necessities. The chain of Congolese middlemen, Ugandan traders and multinational corporations together generate the revenue stream from which armed groups reap substantial financial benefits. Through any purchases of gold made from this network, Metalor Technologies may have contributed indirectly to the revenue stream that supports armed groups in Ituri who carry out widespread human rights abuses. Any failure to terminate relationships with suppliers in Uganda dealing with armed group leaders in Congo may indirectly implicate Metalor in the human rights abuses these groups were committing.

[332] Current multinational activities in both Mongbwalu and Durba are predominately at an exploration stage. AngloGold Ashanti at the time of writing was not yet extracting ore.

[333] Final Report of the U.N. Panel of Experts, October 16, 2002, S/2002/1146, p 152. Recent academic research has also shown how informal or “shadow” economies are subject to criminalization and are often linked with armed groups. See Mark Taylor and Anne Huser, “Security, Development and Economies of Conflict: Problems and Response,” FAFO AIS Policy Brief, November 2003. See also Ballentine, K. and J. Sherman, eds., “The Political Economy of Armed Conflict: Beyond Greed and Grievance”, (International Peace Academy, 2003).

[334] Ibid., Report of the Group of Experts on the U.N. Arms Embargo, January 25, 2005, para 36.

[335] Law No.007/2002 of July 11, 2002 Relating to the Mining Code and replaced the previous Decree/Law No. 81-013 of April 2, 1981 as well as subsequent legislation. Legislation available in English and French at www.miningcongo.cd.

[336] Mining Code, Article 111.

[337] Mining Code, Article 116.

[338] Mining Code, Article 117.

[339] Mining Code, Article 120 and 122.

[340] Human Rights Watch interview, Ministry of Mining officials, Kinshasa, February 29, 2004.

[341] Ibid., Le Potentiel Newspaper, Kinshasa, November 29, 2004.

[342] Human Rights Watch interview, Ministry of Mining official, Kinshasa, February 29, 2004.

[343] Ibid., "Report of the Group of Experts on the U.N. Arms Embargo”, January 25, 2005, para 95.

[344] Human Rights Watch interviews, gold traders, Butembo, Ariwara, and Mongbwalu, March, May 2004. Also interviews with gold traders in Kampala, July 2004.

[345] Ibid.

[346] Customers purchasing gold from Dr. Kisoni in February 2004 saw his gold foundry and the ingots it produced at his place of business. Human Rights Watch interview, Butembo, February 25, 2004.

[347] Human Rights Watch interview, Butembo, February 25, 2004.

[348] Human Rights Watch interview with gold traders in Mongbwalu, May 1 – 5, 2004.

[349] Human Rights Watch interview, Mr. Basiani, FNI Commissioner of Mines, Mongbwalu, May 5, 2004.

[350] Gold export statistics from Uganda indicate the trade is $46 million per year for 2003, of which the vast majority comes from the DRC. Based on such figures it is possible the trade from Butembo could be higher.

[351] Human Rights Watch interviews with gold traders, Mongbwalu and Butembo, February - May 2004.

[352] British All Party Parliamentary Group on the Great Lakes, “Arms Flows in Eastern DR Congo”.

[353] Ibid., Report of the Group of Experts on the U.N. Arms Embargo, January 25, 2005, para 129 and 130.

[354] U.N. internal report on the investigation into the plane seizure in Beni, July 25, 2003.

[355] Human Rights Watch interview, RCD-ML insider, Kinshasa, March 1, 2004.

[356] Human Rights Watch interview, Beni, February 25, 2004.

[357] Human Rights Watch interview, Ministry of Mine officials, Butembo, February 25, 2004.

[358] Mining Code, Article 309.

[359] Human Rights Watch interview, Ministry of Mines officials, Butembo, February 25, 2004.

[360] Ibid.

[361] Human Rights Watch interview, Butembo, February 25, 2004.

[362] Ugandan Bureau of Statistics, Value of Exports by Commodity 1998 – 2003. In 2003 the trade was valued officially as $46 million.

[363] Human Rights Watch interviews, gold traders and other gold industry experts, Ariwara, March 7 and 8, Watsa, May 12, 2004 and Durba, May 11, 2004.

[364] This is in violation of the DRC mining code which reserves the authority to issue such licenses exclusively to the state. Mining Code, Article 16.

[365] Ibid., Report of the Group of Experts on the U.N. Arms Embargo, January 25, 2005, para 116.

[366] The U.N. group of experts on the arms embargo also named Mr. James Nyakuni, Vincent Adjua and Ozia Mazio as other gold traders who work with the FAPC. Ibid., “Report of the Group of Experts on the U.N. Arms Embargo”, January 25, 2005, para 118.

[367] Human Rights Watch interview, gold trader, Ariwara, March 7, 2004.

[368] Human Rights Watch interview with gold traders and business people in Durba, May 13, 2004.

[369] Human Rights Watch interview, Omar Oria, Kampala, March 10, 2004.

[370] Mining Code, Articles 120, 126 , 128.

[371] Human Rights Watch interviews, Ariwara, March 6 and 7, and Aru March 7, 2004.

[372] Ibid., Report of the Group of Experts on the U.N. Arms Embargo, January 25, 2005, para 109.

[373] Human Rights Watch interviews Ariwara, March 6, 2004 and March 7, 2004.

[374] While the primary destination is Switzerland, gold is also traded to Dubai, South Africa and other European countries.

[375] All these requirements are set out under the Mining Code of July 2002.

[376] Human Rights Watch interviews with representatives from Uganda Commercial Impex Ltd, Machanga Ltd and A. P. Bhimji Ltd, Kampala, July 7 and 8, 2004.

[377] U.S. Geological Survey, “The Mineral Industry of Uganda”, 1997.

[378] Human Rights Watch interviews with representatives from Uganda Commercial Impex Ltd, Machanga Ltd and A. P. Bhimji Ltd, Kampala, July 7 and 8, 2004.

[379] E-mail correspondence with the Central Bank of Uganda, July 12, 2004.

[380] Ugandan Bureau of Statistics, Value of Exports by Commodity 1998 – 2003.

[381] Annual Report 2002, Ugandan Ministry of Energy and Mineral Development available at www.energyandminerals.go.ug (retrieved at February 2005).

[382] Based on statistics on production from the Ugandan Ministry of Energy and Mineral Development and official export figures from the Ugandan Bureau of Statistics from 1998 to 2003.

[383] Annual Report 2002, Ugandan Ministry of Energy and Mineral.

[384] Human Rights Watch interview, Ugandan Ministry of Energy and Mineral Development Representative, July 2004.

[385] Human Rights Watch interview, Ugandan Bureau of Statistics, Trade Representative, Entebbe, July 2004.

[386] Ibid., Report of the Group of Experts on the U.N. Arms Embargo, January 25, 2005, para 98.

[387] Human Rights Watch interviews with representatives from Uganda Commercial Impex Ltd, Machanga Ltd and A. P. Bhimji Ltd, Kampala, July 7 and 8, 2004.

[388] Human Rights Watch interview, Kanal Chune, Uganda Commercial Impex Ltd, Kampala, July 7, 2004.

[389] Ibid.

[390] Human Rights Watch interview, Jigendra Jitu, Machanga Ltd, Kampala, July 8, 2004.

[391] Ibid.

[392] Ibid., Report of the Group of Experts on the U.N. Arms Embargo, January 25, 2005, pages 30-33.

[393] Human Rights Watch interview, World Bank economist, Kampala, July 2004 and diplomatic economic advisors, Kampala, July 2004.

[394] Steven Odeu, “Uganda gets funds to explore minerals,” New Vision, January 22, 2004.

[395] Ugandan Export Promotion Board, Export Bulletin, News Highlights: Presidents’ Export Aware (PEA) 2002, Edition 3, Jan-March 2004. Also President Export Award 2002, Evening Programme, December 5, 2003. Ugandan Commercial Impex Ltd also won the Gold Award in 1998 and 1999.

[396] Ugandan Government Draft Mining Regulations 2004, Subsection 3, Section 117.

[397] Ibid., U.N. Panel of Experts reports, April 12, 2001 (S/2001/357) para 215, and October 16, 2002 (S/2002/1146) paras 174 and 175.

[398] Ugandan Bureau of Statistics, “Statistical Abstract 2003”, Exports by Region and Country of Destination 1998 – 2002.

[399] Administration Fédérale des Douanes (AFD), Commerce Extérieur de la Suisse, “Statistiques Selon Les Pays et Marchandises", 1998, 1999, 2000, 2001, 2002, 2003.

[400] Human Rights Watch interview, Swiss official, Berne, January 26, 2005.

[401] Human Rights Watch interviews, Swiss customs agents, Berne, January 26, 2005. Free ports also exist in other countries, but control of free ports in Switzerland is considered weaker than that in other European countries, making it attractive for many traders.

[402] Human Rights Watch interview, Swiss trade official, Berne, January 26, 2005. A statement supported by a Ugandan based trader who stated he sold gold to Swiss banks, Human Rights Watch interview with representatives from Uganda Commercial Impex Ltd, July 7, 2004.

[403] Human Rights Watch interview, Swiss customs agent, Berne, January 26, 2005.

[404] Ibid.

[405] Human Rights Watch interview, Swiss industry expert, Berne, January 26, 2005.

[406] “Annual Report 2003”, Metalor Technologies International SA.

[407] Human Rights Watch interview, Jigendra Jitu, Machanga Ltd, Kampala, July 8, 2004

[408] Human Rights Watch interview, Jigendra Jitu, Machanga Ltd, Kampala, July 8, 2004.

[409] Ibid., Report of the Group of Experts on the U.N. Arms Embargo, January 25, 2005, p. 32.

[410] Dr. Scott Morrison, Chief Executive Officer, Metalor Technologies to Anneke Van Woudenberg, Human Rights Watch, December 17, 2004. Document on file at Human Rights Watch.

[411] Ibid., Also Letter from Dr. Scott Morrison, Chief Executive Officer, Metalor Technologies to Anneke Van Woudenberg, Human Rights Watch, April 14, 2005. Also e-mail from Morrison to Van Woudenberg, February 1, 2004. Documents on file at Human Rights Watch.

[412] Human Rights Watch interview, Mrs Nawal Ait-Hocine, Head of Legal and Compliance, Metalor Technologies SA, Neuchâtel (Switzerland), April 21, 2005.

[413] Ibid., Morrison to Van Woudenberg, December 17, 2004 and April 14, 2005. Documents on file at Human Rights Watch. Also Human Rights Watch interview, Mrs Nawal Ait-Hocine, Head of Legal and Compliance, Metalor Technologies SA, Neuchâtel, Switzerland, April 21, 2005.

[414] Human Rights Watch interview with Mrs Nawal Ait-Hocine, Head of Legal and Compliance, Metalor Technologies SA, Neuchâtel, April 21, 2005. Also Ibid., Metalor Annual Report 2003.

[415] Ibid., Morrison to Van Woudenberg, e-mail correspondence, February 1, 2005. Document on file at Human Rights Watch.

[416] Ibid., Morrison to Van Woudenberg, April 14, 2005.

[417] Human Rights Watch interview with Mrs Nawal Ait-Hocine, Head of Legal and Compliance, Metalor Technologies SA, Neuchâtel, April 21, 2005.

[418] Ibid.

[419] Ibid.

[420] Ministry of Energy and Mineral Development, Government of Uganda, Annual Report, 2002.

[421] Ibid.

[422] Human Rights Watch interviews with representatives from Uganda Commercial Impex Ltd, Machanga Ltd and A. P. Bhimji Ltd, Kampala, July 7 and 8, 2004.

[423] There were numerous public reports about the situation in Ituri and the human rights abuses of armed groups. For reports published in Swiss newspapers see, for example, “Or: la descente aux enfers,” L’Hebdo, July 29, 1999; David Haeberli, “Justice : La Suisse bloque 13 millions de dollars issus d’un trafic de minerai congolais”, Le Temps, November 30, 2002; Alexis Masciarelli, “Après le départ de l’armée ougandaise, les massacres interethniques reprennent à Bunia,” Le Temps, May 12, 2003 ; “Les vraies causes des guerres civiles: Misère ethnique? Non, économique”, L’Hebdo, June 19, 2003; “La CPI s’intéressera tout d’abord au Congo. Deux priorités pour le procureur de la CPI : L’Ituri et le business de la guerre”, La Tribune de Genève, July 17, 2003. See also Ibid., Reports from Human Rights Watch, March 2001, October 2002 and July 2003; Amnesty International, October 2003; International Crisis Group, June 2003; U.N. Security Council, July 2004 amongst others.

[424] See reports from the Panel of Experts on the Illegal Exploitation of Natural Resources and Other Forms of Wealth of the Democratic Republic of Congo, April 12, 2001 (S/2001/357), May 22, 2002 (S/2002/565), October 16, 2002 (S/2002/1146), October 23, 2003 (S/2003/1027) plus other addendums.

[425] Ibid., Human Rights Watch interview with Mrs Nawal Ait-Hocine, Head of Legal and Compliance, Metalor Technologies SA, Neuchâtel, April 21, 2005.

[426] Ibid.

[427] Ibid., OECD Guidelines Paragraph II.10 and General Policies, paragraphs 1 and 2. A recent study in the OECD looked specifically at the issue of trade from conflict zones. See OECD Working Party of the Investment Committee, “Conducting Business with Integrity in Weak Governance Zones: Issues for Discussion and a Case Study of the DRC,” November 26, 2004.

[428] Draft Norms on the Responsibilities of Transnational Corporations and Other Business Enterprises with Regard to Human Rights, E/CN.4/Sub.2/2003/12 (2003), Section A, General Obligations.

[429] Ibid, Metalor Annual Report 2003.

| <<previous | index | next>> | June 2005 |